...

In any group of loans, banks expect there can be some loans that do not perform as expected. These loans may be delinquent on their repayments or default the entire loan. This can create a loss to the bank on expected income. Therefore, banks can set aside a portion of the expected repayments from all loans in its portfolio to cover all or a portion of the loss. In the event of loss or in critical situations banks can use the amount set aside to cover the loss instead of taking a loss in its cash flow. This loan loss reserve acts as an internal insurance fund.

Example:

Let's assume MFI/Bank organization ABC has made $ 100,000 of loans to different individuals and companies. Though ABC MFI/Bank organization works very hard to ensure that it lends to only those people who can repay the total amount on time, naturally some may default, some may fall behind and for some ABC MFI/Bank organization has to renegotiate.

MFI/Bank Organization ABC estimates that 1% of loans amount that is $ 1000 will never comeback. So this $ 1000 is ABC MFIorganization's /Bank's loan loss reserve and it records this amount as negative number on the asset portion of its balance sheet.If and when MFI/Bank organization ABC decides to write all or a portion of a loan off, it will remove the loan from its asset balance and also remove the amount of the write-off from the loan loss reserve. The amount deducted from the loan loss reserve may be tax deductible for MFI/Bank organization ABC.

How to define a Loan Provision:

...

Based on in which category the loan belongs to MFI/Bank organization can reserve the amount based on his country regulations. For example

...

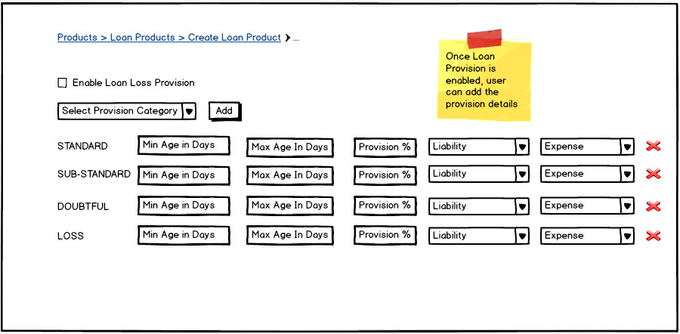

Now how to associate loan provision to a product? In create loan product screen, we have the option to enable loan loss provision as shown in mock up screen below

MFI Organization can choose each category one by one and can add it to the loan product. MFI Organization can choose minimum and maximum over dues in days and can provide provision percentage differently for each loan product. Both Liability & Expense combos will have all GL accounts. So MFI organization can choose liability & expense accounts against each provision category differently,

...

1) Under System-> Manage Scheduler Jobs user , organization can find the loan loss provision job. This job will run at customer defined intervals.

...

After calculating the provision amounts for all active loans, the data will be saved into 'acc_gl_journal_entry'.

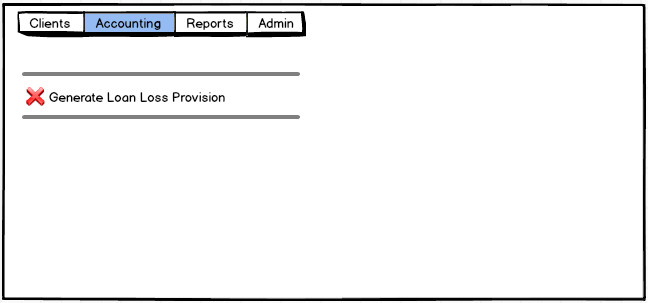

2) User Organization can generate provisioning data manually under accounting section as shown in below mock up screen

...