About Loan Accounts

A loan account is a specific instance of a loan product. A loan account has a unique account number, a specified interest rate, and it is owned by one, and only one, financial institution client.

| Note |

|---|

A client may be an individual or a group. |

A loan account can be created for loan products that are active in Mifos. When a loan account is created, it inherits the rules and defaults from the loan product definition. Some of the inherited information may be modified, depending on the loan product definition.

A client may have multiple simultaneous loan accounts within the financial institution's policies, defined in the Product Mix.

Loan accounts can be opened only for Approved/Active clients.

Charges (fees and penalties) can be charged to loan accounts in three ways:

- Fees Charges are inherited from the product definition. A loan office may have the ability to remove one or more of these fees charges for a loan account. If a fee charge is removed from a loan account, it does not affect other loan accounts.

- Charges (not yet associated with the loan account) can be selected and attached to the loan account.

- Miscellaneous charges (one time charge) can be charged to a loan account. The loan officer specifies the amount, which is added in the next payment.

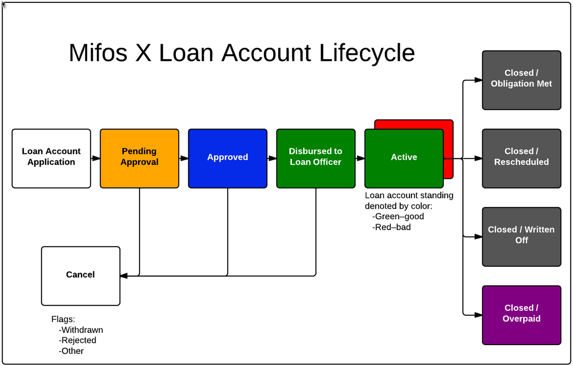

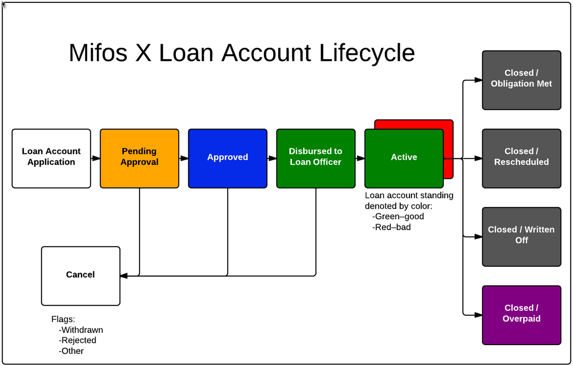

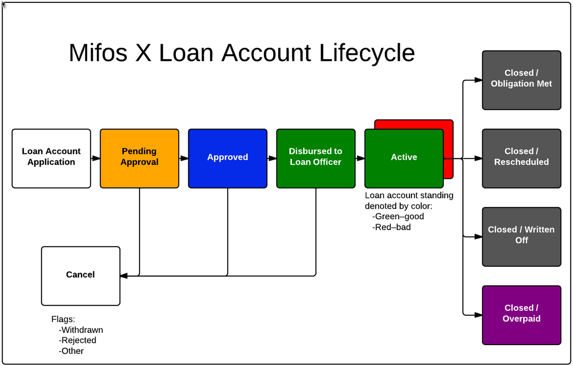

The loan account lifecycle is illustrated in the Mifos X Loan Account Lifecycle Diagram. The  Image Removeddiagram. Loan account states are visually indicated in Mifos X using the color scheme illustrated in the Mifos X Loan Account Lifecycle diagram.

Image Removeddiagram. Loan account states are visually indicated in Mifos X using the color scheme illustrated in the Mifos X Loan Account Lifecycle diagram.

Image Added

Image Added

Mifos X Loan Account Lifecycle