Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

About Loan Accounts

A loan account is an instance of a loan product. A loan account has a unique account number, a specified interest rate, and it is owned by one, and only one, client or group.

A loan account can be created for an active client or group based on a loan product that is active on the Submitted Date. When a loan account is created, it inherits the rules and defaults from the loan product definitionas it is defined on the creation of a loan. Some of the inherited information may be modified, depending on how the loan product is defined.

| Note |

|---|

Existing loan accounts are unchanged when the loan product they are based upon is changed. |

A client may have multiple simultaneous loan accounts within the financial institution's policies, defined in the Product Mix.

| Note |

|---|

In the case of a group loan application, individual client loan accounts belonging to members of the group are included for the purposes of applying product mix rules. |

Loan accounts can be opened for active clients only.

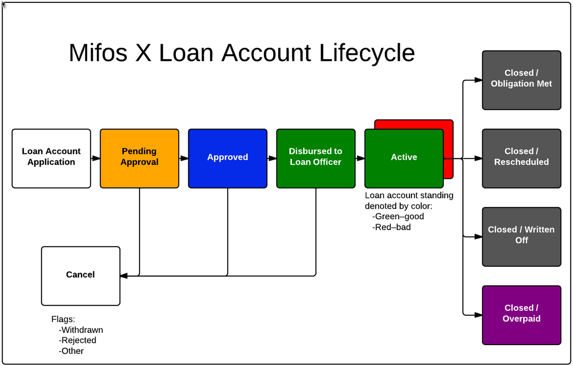

The loan account lifecycle is illustrated in the Mifos X Loan Account Lifecycle diagram. Loan account states are visually indicated in Mifos X using the color scheme illustrated in the Mifos X Loan Account Lifecycle diagram.

Mifos X Loan Account Lifecycle

The actions and transactions for Loan Accounts are:

| Previous State | Action | Resulting State |

|---|---|---|

| N/A | Add Loan | Pending Approval |

| Pending Approval | Add Loan Charge Approve Modify Application Reject Assign Loan Officer Withdrawn by client Delete Add Collateral Guarantor Loan Screen Reports | Pending Approval Approved Pending Approval Cancel (Rejected) Pending Approval Cancel (Withdrawn) N/A Pending Approval Pending Approval Pending Approval |

| Approved | Assign Loan Officer Disburse Disburse to Savings Undo Approval Add Loan Charge Guarantor Loan Screen Reports | Approved Active Active Pending Approval Approved Approved Approved |

| Active | Add Loan Charge Make Repayment Undo Disbursal Waive Interest Write-Off Close (as Rescheduled) Close Loan Screen Reports | Active Active Approved Active Closed (Written Off) Closed (Rescheduled) Closed (Obligation Met) or Closed (Overpaid) Active |

An active loan account in good standing is indicated by a green status. A active loan account that is not in good standing is indicated by a red status.

Group Loan Accounts

Group loan accounts differ from individual accounts in the following ways:

- Responsibility for the loan is shared equally among the members of a group

Group Loan application : If the group wants take a loan (as group one loan) and do not want track how the loan is spitted between (among)the group members and as group repayment is collected. In this case only one loan account is created against the particular group. ( This is feature is useful for Bank linkage programs, where Nationalized Banks provide loan to a group rather than to member and as group need to repay the loan ex: SHGs)

About Loan Charges

Charges (fees and penalties) can be charged to loan accounts in three ways:

- Charges are inherited from the product definition. A loan officer may have the ability to remove one or more of these charges for a loan account. When a charge is removed from a loan account, other loan accounts are not affected.

- Charges (not yet associated with the loan account) can be selected and attached to the loan account.

- Miscellaneous charges (one time charge) can be charged to a loan account. The loan officer specifies the amount, which is added in the next payment.

| Panel | ||||||||

|---|---|---|---|---|---|---|---|---|

On this page:

|

Related articles

| Filter by label (Content by label) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|