...

| Page Properties | ||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Project Summary

Earlier clients were dependent on bank staff (which used Mifos Android Client) for performing any kind of transaction or alteration due to which Self Service app was developed in order to help clients to manage their accounts. Self-Service Android app enables clients to interact with their data. Using Self Service v1, clients can perform basic operation such as viewing their account details, loan and share accounts, apply for a loan, transfer money between their own accounts.

Goals

- Allow user to register on app

- Help user to make loan payments

- Allow user to view and update his/her details

- Help user to make Third party transfers

- Allow user to update or delete a pending loan application

- Integrate a mobile wallet

Background, Impact, and User Need

Self-Service currently allow the clients to perform limited functionality so primary goal will be to increase the functionality so that the user can independently and easily manage, transact from their accounts without the need of bank staff.

Project Implementation Plan

Beneficiary for Third Party Transfer(TPT):-

Beneficiary for TPT consists of adding, deleting, updating and displaying the list of all the beneficiaries.

For Adding a TPT beneficiary

Flow diagram :

Updating and Deleting a TPT beneficiary

On clicking on any beneficiary, it would display the details about that particular beneficiary and also provide options to delete or update the beneficiary.For updating , the user will be allowed to update the name and transfer limit for that particular TPT Beneficiary

Update and Delete a pending approval Loan Application:-

By clicking on one of the loan from loan accounts list , user will be able to delete or update the loan with pending approval state from the menu.These option will only be displayed in the loans with a pending state.

For updating a loan we will follow the following steps:

Fetch a particular loan details in order to obtain the productId.

Use the productId to fetch the loan template for that particular productId and loading it to the layout used for creating a loan.

Updating the loan after client made changes

On clicking on Withdraw loan a dialog will be shown asking for confirmation and reason for cancelling as shown in the mockup

Sign Up through application

Sign Up includes 2 steps:-

Client Account Verification process where client will enter mifos account number and their registered phone number.This step is mandatory in order to check the authenticity of the user.

Mock : LinkCreating self service account for the user and link the client account to self service account created which can be implemented in 2 ways:

Make Loan Payment

Implement Loan payment feature from mock provided and is explained briefly here

- Loan Repayment can be considered as a Third Party Transfer so , Third Party Account Transfer Template will be used for loading the accounts in spinner and finally N number of Third Party Transfers will take place for N number of saving account chosen.

- As there can be number of Savings Account which would be used for making payments according to the mock , so a dynamic layout will be added every time user click on the Plus Icon

Dynamic Layout

Moreover a Pay From account should only contain Savings Account these will be filtered using rxjava. - During the time of transfer , transfer of funds will take place for all the savings account chosen during 1st step and these will be executed one by one until all the transfers are completed.

Refactoring Charge Feature

Enhance the current Charge Feature and transforming it into a generic type fragment which will work for client, savings and loan charges.Users will be able to see charges for loan account by clicking on a loan account from loan account list and then by clicking on Show Charges button (same goes for the savings charges).

Mobile wallet integration

...

The community-app (AngularJS Web App) is the standard application which is built on top of the Fineract platform and provides all the core functionality for the most common methods of financial inclusion and products and services. In this project, I will be doing enhancements to the user interface of the community by ensuring the following things:

- Improve performance by introducing lazy loading

- Implement Wizard UI for product and account creation

- Improve the interface for role-based dashboards

- Redesign the client, group, and center records

- Redesign the loan and summary savings pages

- Implement UI for workflows and data-table entity checks

- Creating a style guidelines page

Goals

- Enhanced user experience and usablitiy

Project Implementation Plan

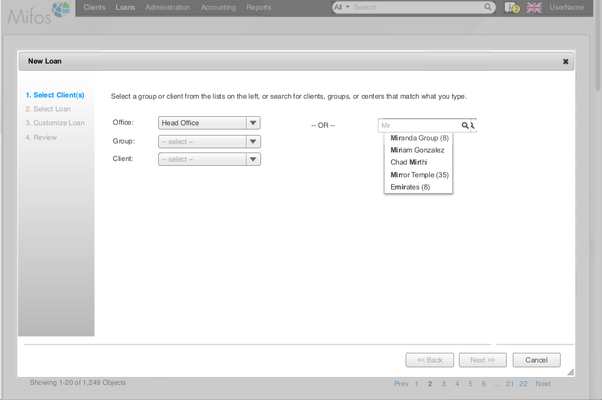

1.Wizard UI for products and Account Creation

Wizard Interface is a process in which a complex form is broken into easier steps for better user understanding and experience. This part of the project involves implementing the Wizard UI to the following products and account creation pages:

● Loan Products Creation

● Saving Products Creation

● Share Products Creation

● Fixed Deposit Products Creation

● Recurring Deposit Products Creation

● New Share Application

● New Savings Application

The community-app is using angular-wizard for creating the wizard interface. All the wizards created would follow a similar layout to the mock up below:

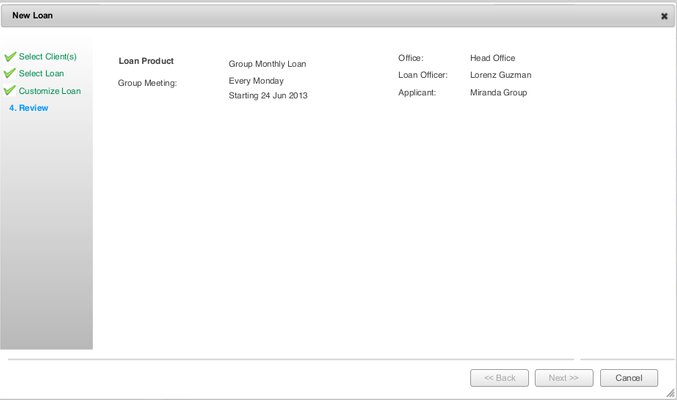

The user should be able to view/edit information in any step and there would be a review step at the end before the completion of the wizard similar to the one shown below:

There wizards would also have indicators, that indicate the state of the steps:

(a)Step has not been completed

(b)Step has been completed

× Select Client(s)

(c)Step has errors

The division of steps in the wizards have been listed as follows:

| Wizard | Steps |

|---|---|

| Loan Product Creation: | ➢ Details |

| Savings Product Creation: | ➢ Details |

| Share Product Creation: | ➢ Details |

| Fixed Deposit Product Creation: | ➢ Details |

| Recurring Deposit Product Creation: | ➢ Details |

| Share Account Application: | ➢ Details |

| Savings Account Application: | ➢ Details |

2. Improve interface for role-based dashboards:

The current dashboard of the community-app is used to show details like recent/frequent activities and statistical data about client trends, amount disbursed, amount collected (which is only available for super user). However, the community-app is lacking role-based dashboards. So, this part of the project involves adding an enhancement to include custom dashboards based on the role of the user.

The basic idea is the identify the role of the user when he/she is logged in and route to the corresponding dashboard view. By creating different dashboard templates ( something like: dash_admin.html , dash_LoanOfficer.html) It would be possible to load the dashboard views based on the permission of the current user. The permissions of the current user could be accessed by `scope .currentSession.user.userPermissions` and these permissions will be compared with the permissions for the required dashboard. Based on this, we could identify the dashboard template for the logged in user. This is similar to how the home page work in the community-app using the 'getHomepageIdentifier()'.

The roles and templates for the dashboard require further discussions with the mentor(s) and the community.

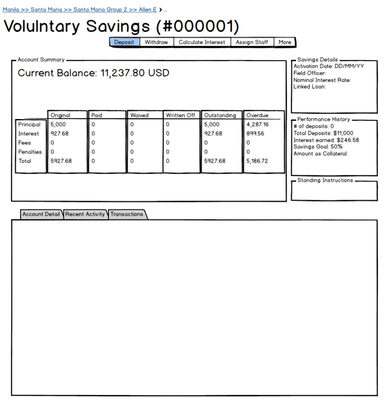

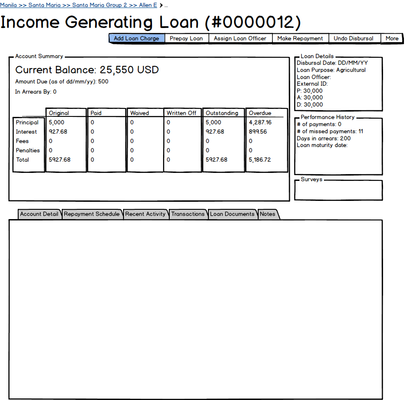

3. Redesign loan and summary savings pages:

Re design is required for the current loan and savings detail pages. I will be referring the following mock ups for the redesign of loan and savings pages:

Savings Summary:

Loan Summary:

4. Redesign Client, Group and Center records:

5. Performance Improvements by introducing Lazy Loading:

Currently, in the community-app all the scripts are loaded and rendered in a single go. However, since the community-app has a huge codebase, it might not be a good approach to load all the scripts when the app starts because:

- Performance would reduce:

The community-app has a huge codebase hence there are a lot of scripts is required to be loaded. Loading all of them at once may take lot of time and data which leads to less performance. - Waste of scripts

Consider a case where the user just wants to access one part of the app. In this case, following the normal approach (where all scripts are loaded at once) may not be an efficient method since this might lead to a lot of unwanted scripts which we don't require. Hence, It would be better if we only loaded the scripts which is required

Hence by Lazy Loading the scripts, we only load the script when required ( when the route is accessed ). This reduces the amount of scripts loaded at a single time and also the performance would be improved.

For the Lazy Loading, I will be using a AngularJS library known as ocLazyLoad.

6. Workflows and Entity Data table checks

7. Style Guidelines Page

With the increasing number of contributors to the Mifos Initiative and the community-app, we also need to make sure that the changes made by the developers in any user interface should maintain the design standards of the same.

This part involves creating a style guidelines page so that developers could easily refer to it and make changes. The guidelines page would contain the components and UI elements which are used in the community-app. Also, we could include some code snippets for certain CSS classes, icons, alerts etc. So that developers could just pick the components and ensure that the changes made follow the design standards of the app.

Schedule/Timeline

Interval | Tasks | |

|---|---|---|

Community Bonding Period (4 May -30 May ) | ||

4 May - | ||

15 May |

Improving the mocks according to mentor review

Understanding API and mocks for Mobile wallet integration.

16 May - |

30 May | End Semester Exams | |

Coding Period Begin (30th May) | ||

|---|---|---|

Week 1 [31th May-6th June] | ||

Feature to Update Loan Application

Week 2 [7th June-13th June] | ||

Refract Charge Fragment to show client, loan and savings charges from same fragment and presenter

Week 3 [14th June-20th June] | |

Week 4 [21th June-27th June] | ||

Phase 1 evaluations (26th June - 30th June) | ||

|---|---|---|

Week 5 [30th June-4th July] | ||

Implementing Third Party Account Transfers

Week 6 [5th July-11th July] | |

Mobile Wallet Integration

Week 7 [12th July-18th July] | |

Implementing User Sign up while considering all the cases for user to sign

Week 8 [19th July-25th July] | |

Continuing with implementation of User Sign Up

Displaying User Details feature

Phase 2 evaluations (24th July - 28th July) | ||

|---|---|---|

Week 9 [28th July-1st Aug] | ||

Week 10 [2nd Aug-8th Aug] | ||

Week 11 [9th Aug-15th Aug] | ||

Implementing Unit testing for the previous features and

for the features implemented for Self Service version 2.0

Week 12 [16th Aug-20th Aug] | ||

Final evaluation | ||

|---|---|---|

Self-Service API's Status

TPT beneficiaries:-

Self Service Phase 2 Info : Customer Self Service - Phase 2Additional Resources

MockUps: https://openmf.mybalsamiq.com/projects/mifosandroidself-serviceapp/grid

Product Document:Self-Service Android Application Product Document

User Stories: https://mifosforge.jira.com/wiki/display/projects/User+Stories

Roadmap: https://mifosforge.jira.com/wiki/display/projects/Self-Service+Android+Application+Roadmap

Self Service Info: https://mifosforge.jira.com/wiki/display/MIFOSX/Customer+Self+Service