| Target release | 16.03 |

|---|---|

| Epic | |

| Document status | |

| Document owner | |

| Designer | Lead designer |

| Developers | Lead developer |

| QA | Lead tester |

|

Nearly every country has banking regulations regarding the manner in which inactive savings accounts are managed by a financial institution. The terms used to describe these accounts include the words "inactive," "dormant," "unclaimed property", "inoperative". Regardless of the terms used by the various central banks, the financial institution has a fiduciary responsibility to manage these funds in certain ways from account holder notification to turning the funds over to an unclaimed property account generally management by the region's regulatory agency.

| # | Title | User Story | Importance | Notes |

|---|---|---|---|---|

| 1 | Last Deposit or Withdrawal on Account | System must track last transaction made by customer | Must Have | The transaction may be electronic or in person and must be a deposit or withdrawal |

| 2 | Exclude Interest Payments | Account will continue to earn interest while in an inactive status | Must Have | Interest payments do not activate the account |

| 3 | Inactive Account Fee | Accounts may be charged a fee when the account becomes in active for a set period of time | Must Have | The inactive account fee does not activate the account |

| 4 | Inactive Account Reports | Must be able to pull an inactive account report either on-demand or in the month-end job queue | Must Have | The inactive report must list customer name, account number, contact information, date of last activity, total days inactive |

| 5 | Dormant Account Report | Must be able to pull a dormant account report either on-demand or in the month-end job queue | Must Have | The Dormant Account report lists the above details for accounts xx years old or more. |

| 6 | Escheat Funds | Many FIs will be required to turn abandoned property over to a regulatory body. Must have the ability to debit client account/credit Abandoned Property GL. |

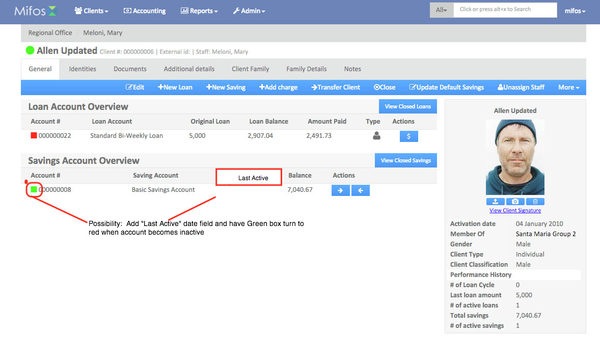

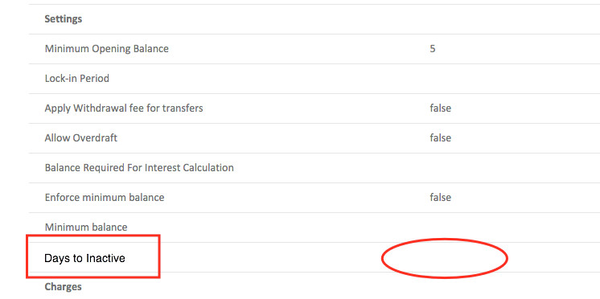

Savings Account Creation Screen:

Fee Creation

Reports

Tran

Below is a list of questions to be addressed as a result of this requirements document:

| Question | Outcome |

|---|---|

What happens to accounts which have -ve balance (overdraft) but fit the definition of inactive/dormant/escheat? | That will be determined by the FI. These typically become a loss to the FI. |

| Overall there will be 3 new status for an account, inactive/dormant/escheated, please confirm. | yes. Typically an account first becomes inactive. Then it becomes dormant. Finally it moves to an escheat status when the proceeds are turned over to a regulatory body. |

| Fee applicable would be flat or can be % as well? | That will be determined by the FI. There should be a choice |

| Abandoned property account would be an expense or liability type account? | abandoned savings is a liability |

| Fee collected would get into what type of account? | Fee collected would go to an income account - typically a sub-heading below Fee Income |

| Is deposit/withdrawal/fund transfers allowed when account is in inactive status? | Yes - the financial transaction reactivates the account |

| Is deposit/withdrawal/fund transfers allowed when account is in dormant status? | Yes - the financial transaction reactivates the account |