Contents:

Tranche Loans Overview

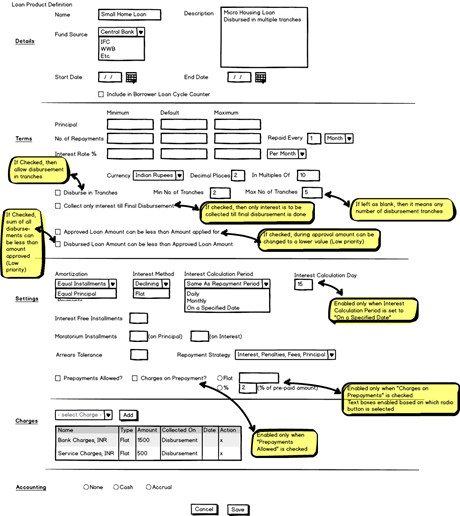

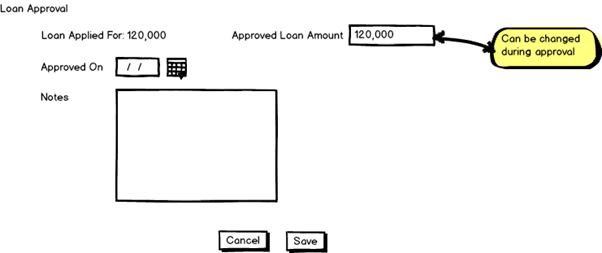

Tranche Loan Product Definition

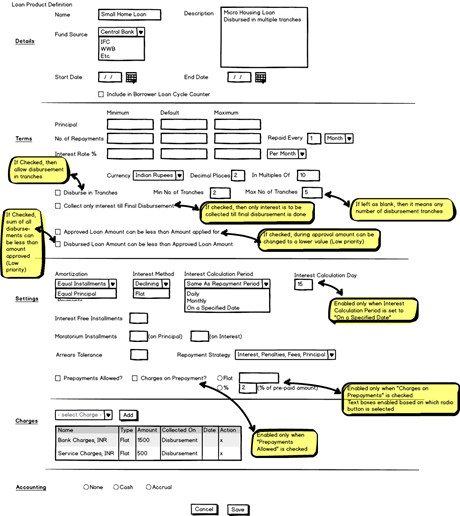

Tranche Loan Creation

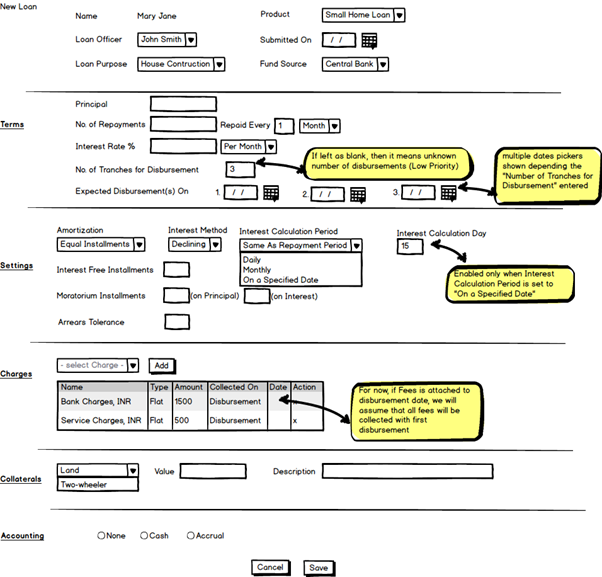

Tranche Loan Approval

Tranche Loan Pre-Payments

Tranche Loans are loans which are disbursed in multiple disbursements. An example of Tranche Loan is Home Loans, which are disbursed in multiple steps as per the progress in completion of the house/apartment being purchased or constructed.

Example:

Completion of the foundation of building – 30% of approved loan amount is disbursed

Completion of the ground floor walls – 30% of approved loan amount is disbursed

Completion of the roof – 30% of approved loan amount is disbursed

Completion of plastering – remaining 10% of approved loan amount

Typically, the loan amount applied for, approved loan amount and total disbursed loan amounts can be different. For example, the client may apply for a loan of 125,000, the approved amount may be 110,000 and the actual disbursement may be 100,000

New data to be captured or modifications to existing fields:

Field Name | Type | PriorityMust – 1Should – 2Could – 3 | Description | Validations / Notes

|

|---|---|---|---|---|

Disburse in Tranches (New Field) | Checkbox | Must Have | Specifies if this loan product can support multiple disbursements | True or False Default would be false (un-checked) |

“Minimum No. of Tranches” and “Maximum No. of Tranches” (New Fields) | Numeric without decimals | Must Have | These fields specify if there are rules on how many times disbursement can be done for this loan. If left as blank, it means there can be any number of disbursements | Default is blank. These fields are enabled only when “Disburse in Tranches” is checked |

Collect Only Interest Till Final Disbursement (New Field) | Checkbox | Must Have | If Checked: Only Interest is collected till final disbursement is done

If un-Checked: Both Interest and Principal is collected after the 1st disbursement is done | True of False. Default is true (checked) i.e. only interest will be collected till final disbursement is done. After final disbursement is done, both principal and interest will be collected. These field is enabled only when “Disburse in Tranches” is checked. |

Approved Loan Amount can be less than Amount Applied For (New Field) | Checkbox | Must Have | If Checked, then during approval process the amount can be changed by approver (amount can only be less than amount applied for) | True of False. Default is true (checked). These field is enabled irrespective of whether “Disburse in Tranches” is checked or not. This field can be applicable for all types of loans. |

Disbursed Loan Amount can be less than Amount Approved (New Field) | Checkbox | Must Have | If Checked, then sum of all amounts disbursed for this loan can be less than the amount approved (i.e. final disbursements can be done even if sum of all amounts disbursed is less than amount approved).

Sum of all amounts disbursed on this loan can never be more than the Amount Approved. Else, disbursements will fail. | True of False. Default is true (checked). These field is enabled only when “Disburse in Tranches” is checked. |

Interest Calculation Period (existing field to be modified) | Dropdown | Could Have | New Option to be added in dropdown “On a Specified Date” Interest will be calculated at “Interest Calculation Day” specified. |

|

Interest Calculation Day (New Field) | Numeric without decimals | Could Have | Specified which specific day the interest should be calculated and applied on (for example, 15th day of the repayment period) | Enabled only when Interest Calculation Period is set to "On a Specified Date". Can have values 1 to number-of-days-present in the repayment period) |

Pre-payment Allowed (New Field) | Checkbox | Should have | When checked, pre-payments (principal re-paid can be larger than the due amount or a lump-sum can be repaid on this loan on any | Applicable for all loans products and not just for tranche loans. Default is false. |

Charges on Pre-payment? (New Field) | Checkbox | Should have | Specifies if there any additional charges when there is a pre-payment | Enabled only when "Prepayments Allowed" is checked |

Flat or Percentage | Radio Button and Text boxes | Should have | Specifies how the additional charges for pre-payment are calculated: a) a flat amount or b) a percentage of the pre-paid amount | Enabled only when "Charges on Prepayments" is checked. Only one of “Flat Amount” text box or “Percentage” text box is enabled based on which radio button is selected. |

Sample Screen:

New data to be captured or modifications to existing fields:

Field Name | Type | Priority Must – 1 Should – 2 Could – 3 | Description | Validations / Notes |

No. of Tranches for Disbursements | Numeric without decimals | Must Have | Specifies the number of tranches for this loan | Default is blank. This field is to be displayed only when “Disburse in Tranches” is checked for the corresponding loan product |

Expected Disbursement Date(s) | Date Fields with Date Pickers | Must Have | These are the expected dates on which disbursement is to be done. N number of dates are to be captured (N = number of tranches for disbursement) | No Default. These fields are to be displayed only when “Disburse in Tranches” is checked for the corresponding loan product. All dates should not be in the past. |

Interest Calculation Period (existing field to be modified) | Dropdown | Could Have | New Option to be added in dropdown “On a Specified Date” Interest will be calculated at “Interest Calculation Day” specified. |

|

Interest Calculation Day (New Field) | Numeric without decimals | Could Have | Specified which specific day the interest should be calculated and applied on (for example, 15th day of the repayment period) | Enabled only when Interest Calculation Period is set to "On a Specified Date". Can have values 1 to number-of-days-present in the repayment period) |

Sample Screen:

New data to be captured:

Field Name | Type | Priority Must – 1 Should – 2 Could – 3 | Description | Validations / Notes |

Approved Loan Amount | Currency Amount Field with decimals | Must Have | If Loan Amount is different from Loan Amount Applied for, then it can be specified here. | Default is the same as Loan Amount Applied for. User can change it during loan approval. Cannot be blank. |

Sample Screen:

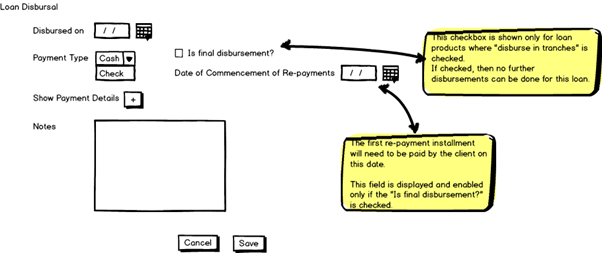

If it is not the final disbursement and the loan is a tranche loan, then the status of the loan should be set to “Partially Disbursed”.

Interest or Principal+Interest can be collected depending on the loan product definition.

If it is final disbursement, then status of loan should be set to “active”.

New data to be captured:

Field Name | Type | Priority Must – 1 Should – 2 Could – 3 | Description | Validations / Notes |

Is final disbursements | Checkbox | Must Have | Specifies if this is the final disbursement. If this is the final disbursement, then no further disbursements can be done on this loan. | Default is unchecked. When checked, an additional message (in Red) should be displayed that “no further disbursements can be done on this loan”. |

Date of Commencement Of Re-payments | Date with Date Picker | Could Have | Specifies date from which the Re-payments of Principal should start | Cannot be in the past |

Sample Screen:

No changes to existing re-payment functionality.

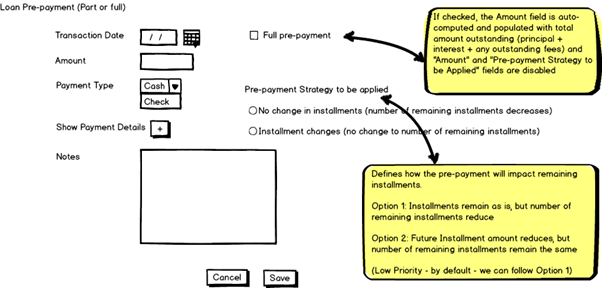

Prepayments are not strictly related to Tranche Loans. However, typical tranche loans like Home Loans frequently need the pre-payment functionality to be available.

Pre-payment will be allowed only after final disbursement.

New data to be captured:

Field Name | Type | Priority Must – 1 Should – 2 Could – 3 | Description | Validations / Notes |

Full pre-payment | Checkbox | Must Have | Specifies if this is full pre-payment. If yes, - The amount will be auto-populated based on the principal + interest remaining - A warning message is to be displayed that the loan account will be closed on submission - Prepayment strategy will be disabled | Default is unchecked. When checked, an additional message (in Red) should be displayed that “loan account will be closed on submission”. |

Pre-payment Strategy to be Applied 2 options are available: No change in Installments OR Installment changes | Radio button | Should Have | No change in Installments – the future installment amounts will remain as is, however number of remaining installments will reduce

Installment changes – future installment amounts will be recomputed based on new principal | Default will be - No change in Installments |

Sample Screen:

Possible sequence in which development tasks can be taken up based on priority.

8.1 Tranche Loans

8.1.1 Creation of Loan Product with Tranches

8.1.2 With Tranche Fields and different approved/disbursed amounts

8.2 Tranche Loan Approval with changed loan amount

8.3 Tranche Loan Disbursements

8.3.1 Intermediate Disbursement

8.3.2 Final Disbursement

8.4 Tranche Loans and Prepayments

8.4.1 Tranche Loan definition with With Pre-payments fields

8.4.2 Pre-payment of tranche loans

8.5 Tranche Loans

8.5.1 With interest calculation on specific date