Loan Charges: Fees and Penalties

Introduction

Along with interest, MFIs may need to use extra charges as a means of covering the costs of providing their credit service. The types of charges associated with loans are often called fees and penalties.

For example a 'processing fee' is often charged with a loan, typically at the time of disbursement of the loan. Often these Fees are one-time fees but some MFIs may need to have recurring fees e.g. loan officer costs to visit rural areas to administer credit services.

Another type of charge is a penalty which is often imposed when late repayments occur.

MFIs apply charges to loans in following situations:

- Ad hoc addition of a fixed amount to loan (something happened that was unforeseen and now mfi must add a charge to loan to recover some cost)

Defined charges such 'processing fee' which is charged with each and every loan (or in product): Usually want these applied automatically with option to waive

- Late repayment 'penalty' charges: Usually want these added automatically

Default charges on Loan Products

In mifos x, we allow a user to associate charges against a loan product by default.

- The chosen currency must match between charge and loan product otherwise the user wont be able to select charge to add to loan product.

- When a user attempts to create a loan against the given loan product, the default charges of the loan product are added and taken into account on the loans repayment schedule.

- Only active charges can be associated with a loan product. If a charge is active and associated with loan product and later is set to inactive, new loans against loan product wont pick up on inactive charges and the inactive charges wont be visible on the loan product maintenance screens.

- Only fee charges are allowed to be associated with a product (Ability to associate a penalty with a loan product doesnt make any sense).

Right now we have a table called m_product_loan_charge that is simply a join table between a m_product_loan and m_charge. No other information is captured when associating charge with product.

Note: The properties of the defined charge may change over time but their is no impact on the association between a given defined charge and a loan product until someone modifies the loan product to remove the defined charge. If the charge is 'de-activated' or 'deleted' then the charge should no longer be associated with the product.

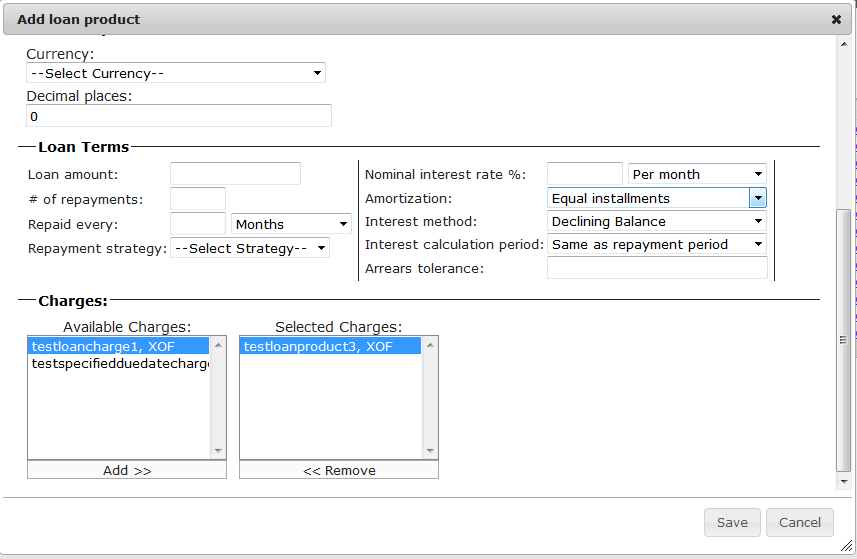

Example UI of possible fields for creating loan product with ability to define default charges against the loan product

Loan charges

In mifos x, we want to support maximum flexibility in what users can do with regards loans and loan charges (fees and penalities). Charges can be associated (or removed) with a loan at the following stages:

- During new loan application process (default charges on loan product automatically picked up, these can be removed or added to during the loan application process)

- After loan application has been created (but not approved/disbursed)

- Any time during the loan contract (after loan is disbursed), possible to add new fee charges or penalty charges that would be due on 'specified date'

When a defined charge is associated with a new loan application or loan, it becomes a loan charge. All details of the defined charge are captured along with the value or amount of the charge. As such when a defined charge is changed, the details of the charge as created against the loan do not change.

Right now we have a table called m_loan_charge that holds all the related information.

At present we only support charges:

- been collected at loan disbursement (see ChargeTimeType.java)

- been calculated using FLAT or % of Disbursed Amount (see ChargeCalculationType.java)

- that are active. If the definition of the charge used for the loan charge is set to inactive during the lifetime of the loan/charge, it doesnt affect existing loans or loan charges.

Other Reading:

- https://mifosforge.jira.com/wiki/display/MIFOS/Functional+Spec+Automatic+Application+of+Late+Payments+Penalties

- https://mifosforge.jira.com/wiki/display/MIFOS/Early+Repayment+of+Fee

Automated application of Penalties:

If a client is late in paying, many MFI's want the penalties associated with this automatically applied.

Consider:

- allow the penalties to be waived/forgiven at their discretion (or partially waved for some of the days)

- allow penalty payments to be made after loan is closed

- Calculation of Fee:

Some MFI's want it a percentage of the principal overdue, some outstanding principal,

others want it a flat fee over a period of time (AlMajmoua charges $1 USD for every day late on a payment) - like by day, per month, or per cycle

- Grace Period:

Some MFI's do offer clients a grace period on lateness. IE, they may have up to 5 days to pay before the penalties are applied.

- Flex Payment: Most will want to collect upon payment of the loan, but others collect at other times. Al Majmoua will collect all the late payment fees as a lump sum AFTER the loan has been paid.