Configuring and Disbursing of Top-Up Loan

A top-up loan allows borrower to take a loan amount on top of his/her existing loan, this loan is offered only after a certain number of repayments is made on existing loan amount as this gives a fair idea about the borrower’s repayment track record. Here the current loan will be paid-off using the balance of top-up loan once the loan is disbursed.

Example:

Assume ‘Bob’ has taken a loan of 10,000$ and say he had made a repayment of 5000$, now he wants to top-up his loan by 10,000$. Once the top-up loan is approved his existing loan amount of 5000$ will be paid-off using balance of top-up loan and a new loan of amount 15000$ is disbursed. This new loan amount is the combination 5000$ (Paid-off amount) and 10000$ (New top-up loan).

Note

Top-up loan amount should be greater than the previous loan balance (principal+Interest).

How to configure Top-Up Loan?

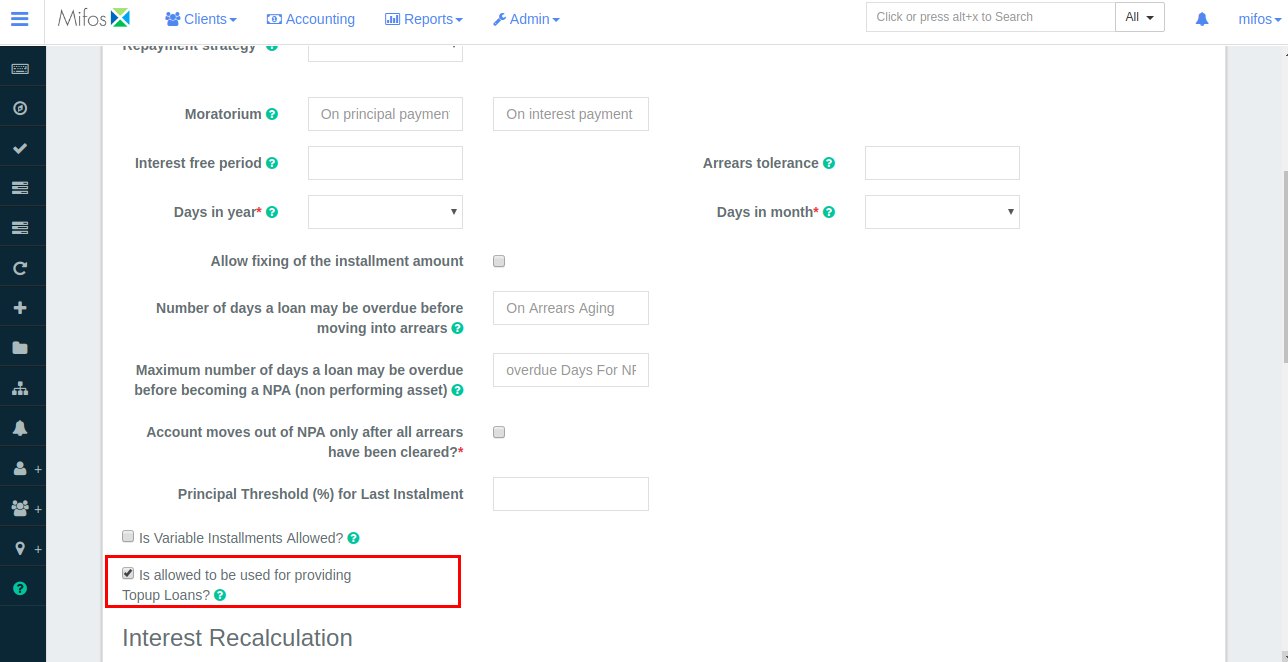

Navigate to Admin>> Products>> Loan Products>> Create Loan Product, define the required fields and if the loan product supports top-up loans then select “is allowed to be used for providing TopUp Loans?” under Settings field.

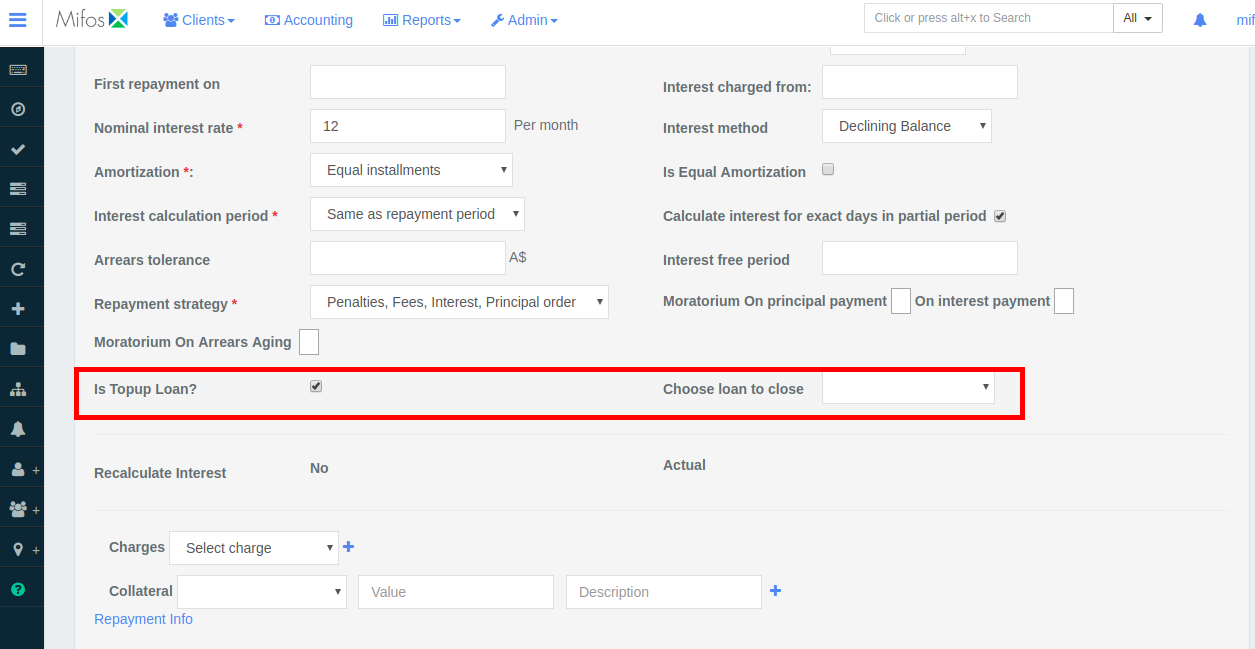

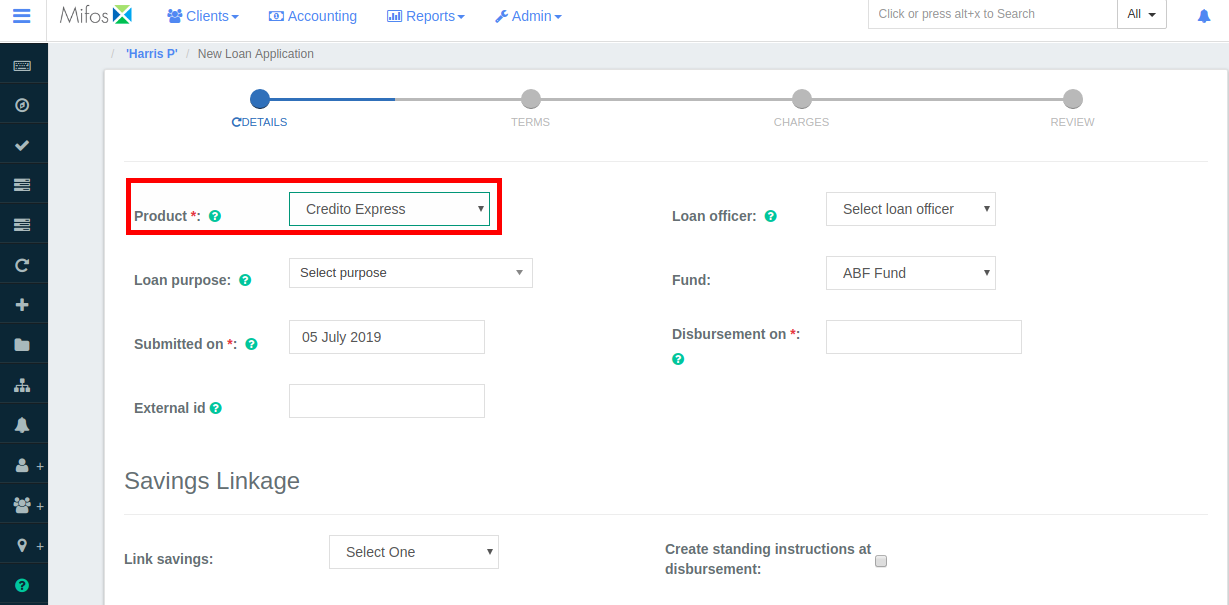

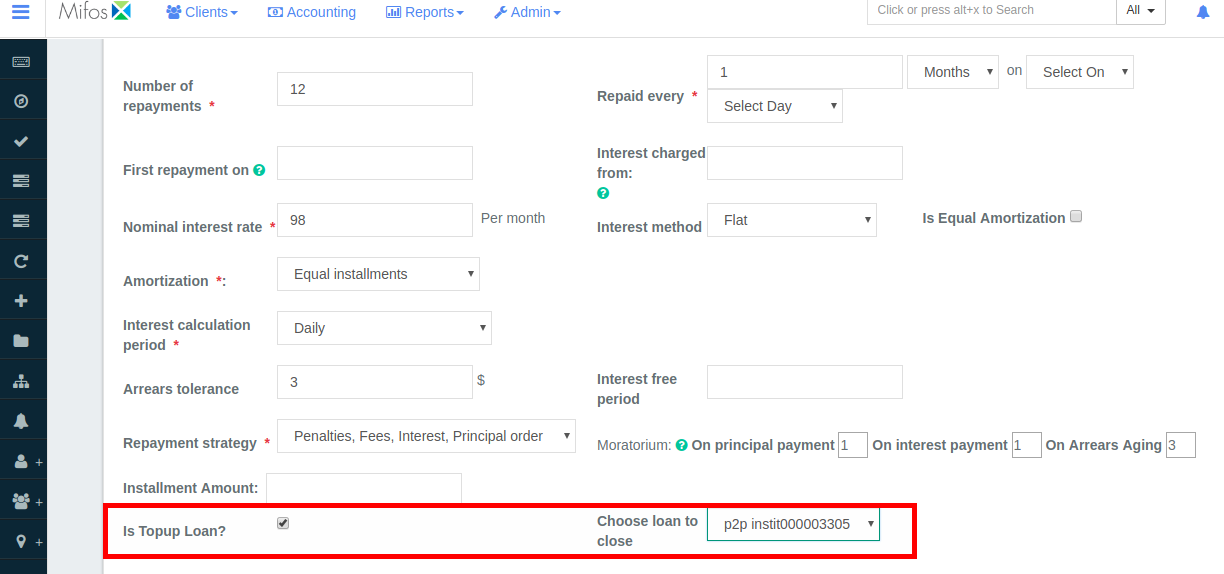

2. Click on the client to whom loan top-up has to be done, next select the ‘loan product’ that is associated with loan top-up feature. Now fill in the required fields in new loan application, select

“is Topup Loan?” and choose the loan account number that has to be closed.

How to Disburse Top-Up Loan?

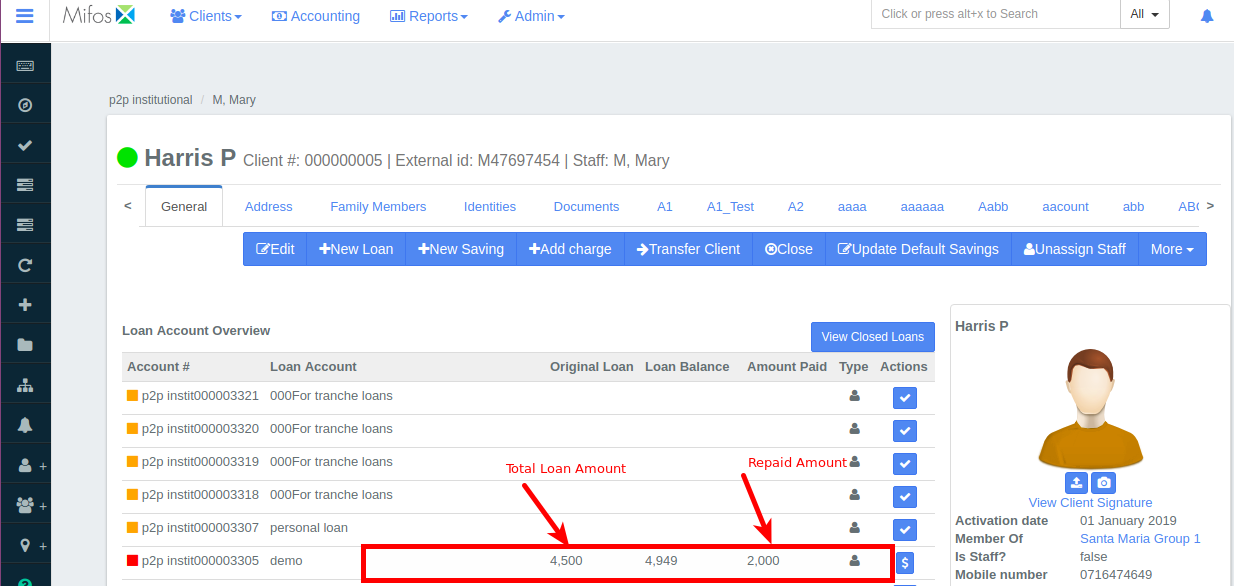

- Select a client who has taken a loan and had made some repayments.

- If the borrower wants to top-up his loan then click on . Next select a loan product that is configured for Top-Up loan.

- Select "Is Topup Loan" and pick the appropriate loan account from "Choose loan to close" drop down that has to be closed (paid-off).

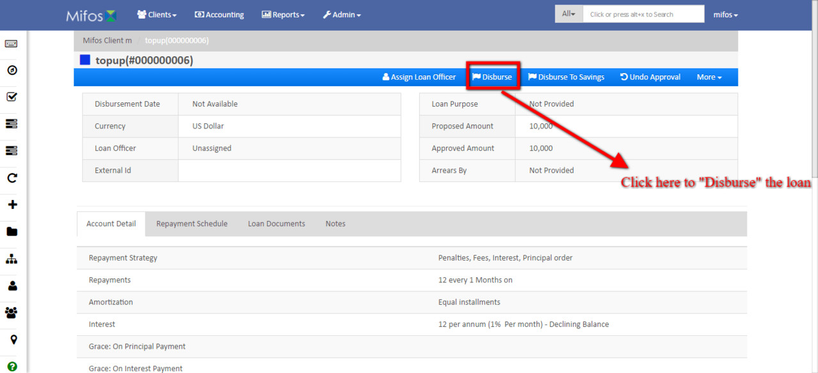

- Click

- Next "Approve" and "Disburse" the loan.

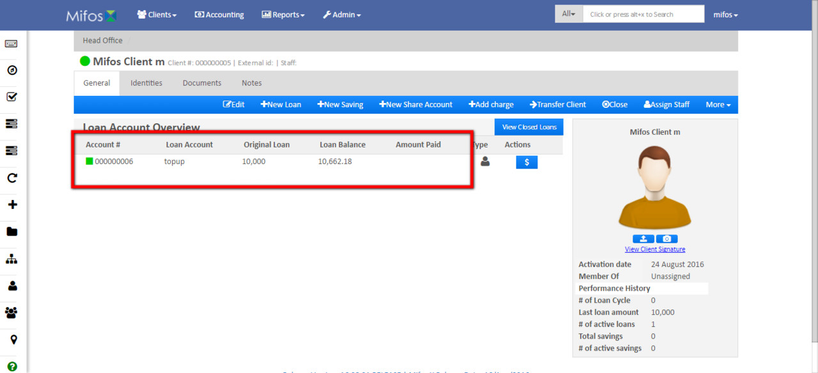

- Now in client's page you can see that the loan earlier has been paid-off and a new Top-Up loan is disbursed.

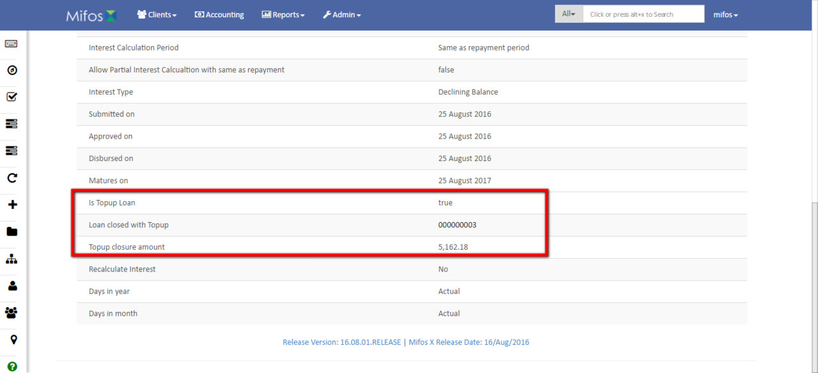

- Click on the loan to view loan 'Summary', 'Transactions', 'Repayment Schedule'.

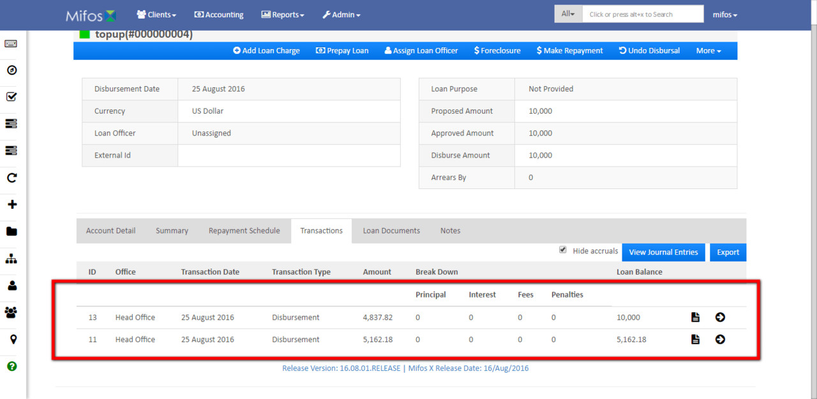

- This is Transaction page.