Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

A Deposit Account is an instance of a Deposit productProduct. A Every Deposit Account Account has a unique account number, and an interest rate (depending on the term and it is ). Deposit Accounts are owned by the clientClients.

A Deposit account Account can be created for an active client based based on a deposit product Deposit Product that is active on the submitted date. When a deposit account Deposit Account is created, it inherits the rules and defaults default configurations from the deposit productDeposit Product. Your financial institution may allow some of the inherited information to be modified for a deposit accountDeposit Account, depending on how the deposit product Deposit Product is defined.

Deposit Account Accounts can be created for:

- Fixed Deposit Product (FD Product)

- Recurring Deposit Product (RD Product)

| Panel | ||||||||

|---|---|---|---|---|---|---|---|---|

On this page:

|

Creating a Deposit Account

For(for Fixed Deposit Product

:1. Go

)

- Go to the Clients List

- by navigating to Clients → Clients from the top menu bar.

Image Added

- Select the Client (for whom the FD account needs to be created) from the list of clients.

Image Added

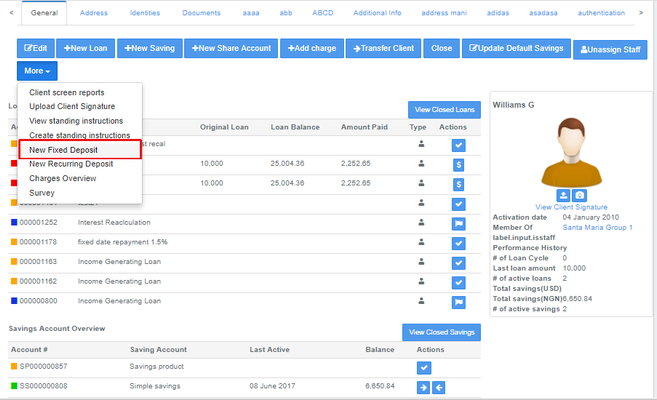

- In the Client's profile,

- click on the 'More' option and click on 'New Fixed Deposit' from the drop-down menu.

Image Modified

Image Modified

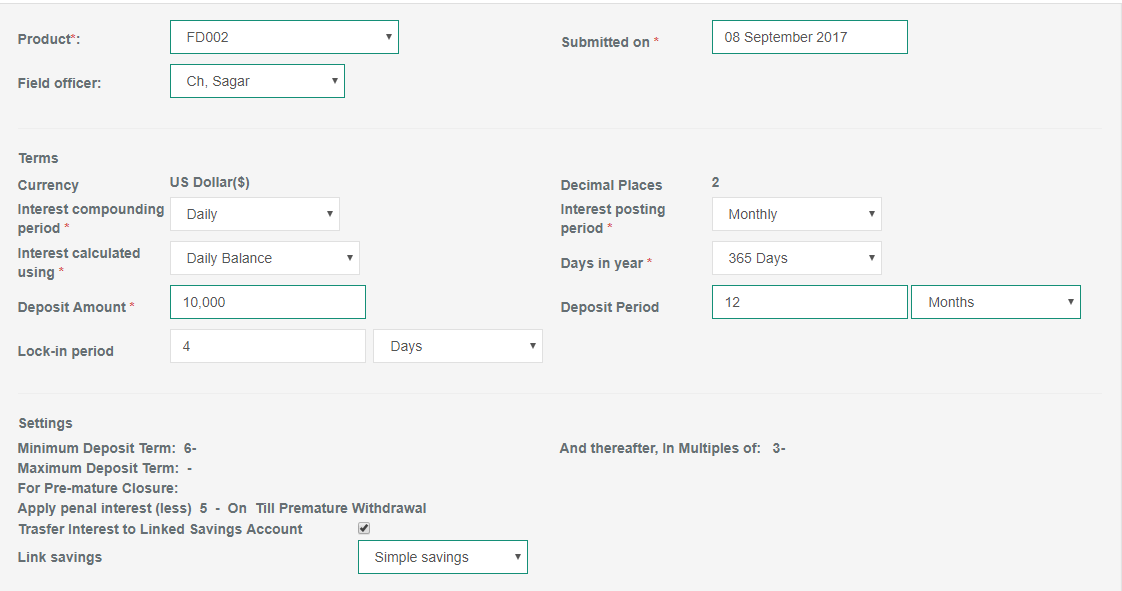

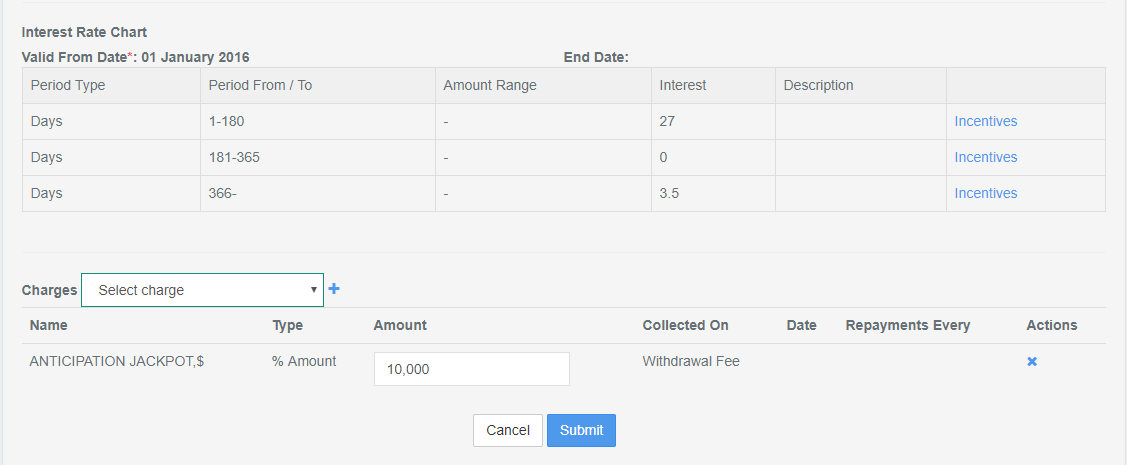

- After clicking on 'New Fixed Deposit', the Fixed Deposit Application will open (as shown below).

Image Modified

Image Modified Image Modified

Image Modified

NOTE: Fields with a red asterisk "*" beside them are mandatory.

Field Name | Description | Example | Validations |

|---|---|---|---|

Submitted On | Enter the FD Application Submitted Date provided by the Client. | ||

Deposit Amount | Enter the Deposit Amount ( It Shouldit should be inbetween the minimum and maximum deposit amount provided in the FD product). | ||

Deposit Period | Provide the duration of the deposition. | ||

Locking Period | The amount can be locked for a given period during which withdrawal or premature closure of FD Account is not possible. | ||

Link Savings | Once the FD reaches to maturity, the interest can be posted to the given savings account. |

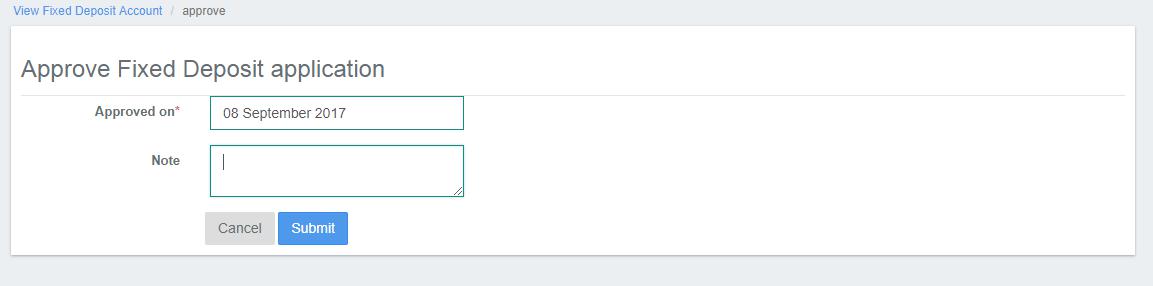

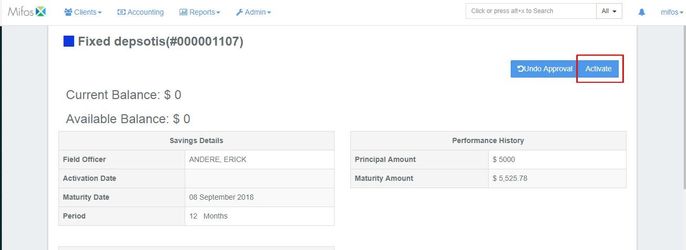

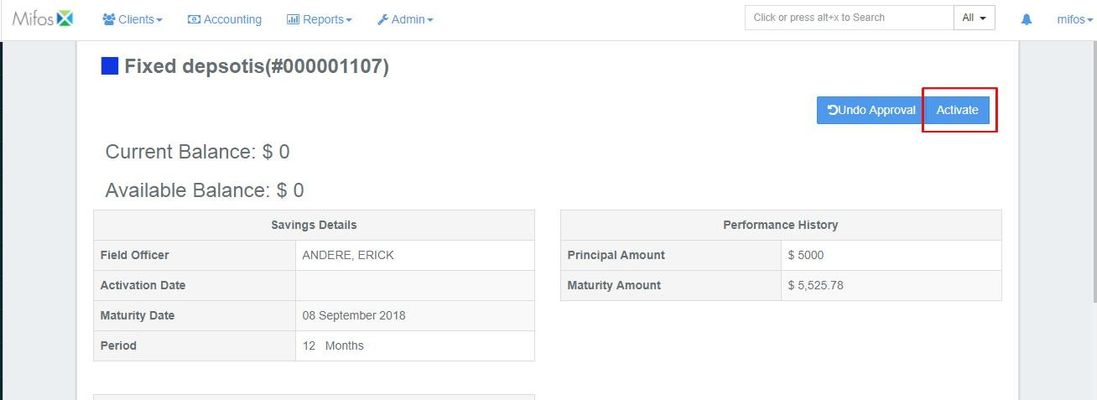

45. Once all the details are entered in the FD application and the application has been submitted, it needs to be approved with date.

56. Finally, the FD account needs to be activated with the specified date. Click on the blue "Activate" button in the top-right corner to activate.

Image Removed

Image Removed Image Added

Image Added

See For more information on how to create Recurring Deposit Accounts, see Recurring Deposit Account.

Related articles

| Filter by label (Content by label) | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|