...

| Field Name (attribute) | Description | Example | Validations (if applicable) |

|---|---|---|---|

| Details Section | |||

| Product name | The product name is a unique identifier for the fixed deposit product. The product name is used:

| Monthly Interest fixed deposit | Required field Alphanumeric |

| Short name | The short name is a unique identifier for the fixed deposit product. The short name is used:

| MIS | Required field Alphanumeric |

| Description | The description is used to provide additional information regarding the purpose and characteristics of the fixed deposit product. | Monthly Interest fixed deposit | Alphanumeric |

| Terms Section | |||

| Currency | The currency to be used for the fixed deposit product. Select the fixed deposit product's currency from the Currency list. | Required field | |

| Decimal places | The number of decimal places to be used to track and report on fixed deposit accounts based on the fixed deposit product. | 2 | Required field Numeric |

| Multiples of | Here you can provide multiple of currency, for example, if you provide "multiple of 10", then the currency values will be rounded off to 20, 30,.. 140, 150.... If you provide "multiple of 100", then the currency values will be 200, 300, 400.....1500, 1600, 1700.. etc. | 0 | Required field Numeric |

| Minimum Deposit Amount | The minimum deposit amount required to open a fixed deposit account based on this fixed deposit product. | 200 | Optional field Numeric |

| Deposit Amount | The default deposit amount expected when a fixed deposit account based on this fixed deposit product is opened. | 500 | Required field Numeric |

| Maximum Deposit Amount | The maximum deposit amount allowed when a fixed deposit account based on this fixed deposit product is opened. | 10000 | Optional field Numeric |

Interest compounding period | The period at which interest rate is compounded. It is normally monthly, quarterly, etc.. | Monthly | Required field Select from list |

| Interest posting period | The period at which interest rate is posted or credited to a fixed deposit account based on this fixed deposit product. | Monthly | Required field Select from list |

| Interest calculated using | The method used to calculate interest. | Average Daily Balance | Required field Select from list |

| Days in years | The setting for number of days in year to use used to calculate interest. Normally, it is 360 days or 365 days. | 360 | Required field Select from list |

| Setting Section | |||

| Locking period frequency | A period of time during which a fixed deposit account based on this fixed deposit product will be locked-in after it is opened. During the lock-in period, the client will be unable to access any funds deposited in the account and premature close of FD Account is not possible if lock-in period is set. | 3 Months | Optional Number and select from list |

| Minimum Deposit Term | The minimum length of time the funds must remain in the fixed deposit account to earn the full interest income. | 6 Months | Required? Number and select from list |

| And thereafter, in Multiples of | After the minimum deposit term has passed, additional deposit duration may be specified. Each of these additional deposit duration must be complete for the fixed deposit account to earn the full interest income. | 1 Month | Optional Number and select from list |

| Maximum Deposit Term | The maximum length of time funds may be deposited in a fixed deposit account based on this fixed deposit product. If the client doesn't want to withdraw or transfer funds to any savings account, he can again extend it for another term. | ||

For Pre-mature Closure: Apply penal interest (less) On | Complete this section to define an interest penalty for pre-mature closure is expressed as a percentage to deduct from the interest rate applicable to either:

The interest rates applicable for various time frames are defined in the Interest Rate Chart(s) for the fixed deposit product. Example: The fixed deposit product has a 6 month term. For the first 90 days, the interest rate is 4.5%, and for 91-180 days, the interest rate is 5% (based on the Interest Rate Chart in effect). The settings for Pre-mature closure are 1% penal interest and Till Premature Withdrawal. A client with a fixed deposit account based on the fixed deposit product, withdraws funds after 60 days. The interest that the client will be paid on withdrawing funds is 3.5% (4.5%-1%). If the settings had been 1% penal interest and Whole Term the client would be paid 4% (5%-1%) on withdrawing funds. | Check box checked 1% Till Premature Withdrawal | Options Check for True; uncheck for False (no interest penalty) Numeric Select from list |

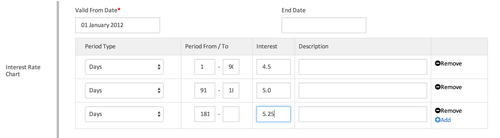

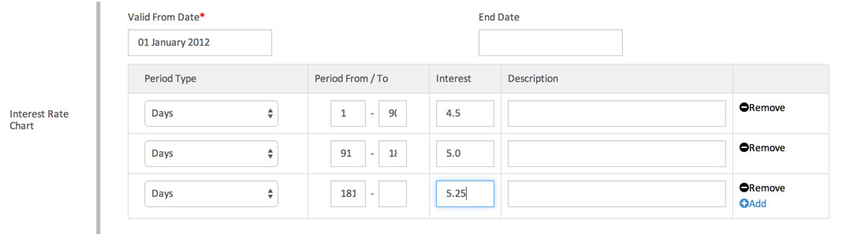

Interest Rate Chart For info on amount range interest rate chart, please refer - Interest rate chart with amount range The interest rate chart provides the information required to calculate the interest payable on a fixed deposit account based on the fixed deposit product. When a fixed deposit product is defined you must set up on and only one interest rate chart. Additional interest rate charts can be set up after the fixed deposit product has been created. When an a fixed deposit product is initially created, the Interest Rate Chart table will be empty. Click +Add to create the first and any additional rows required. Example | |||

| Valid From Date | The Valid From Date is the date from which the Interest Rate Chart will be in effect. | 01 January 2012 | Required field Select from date picker |

| End Date | The End Date is the date after which the Interest Rate Chart will not be in effect. Leave this field blank if the Interest Rate Chart end date is unknown. | blank | Optional field Select from date picker |

| Period Type | The period type may be expressed in Days, Weeks, Months, or Years | Days | Required for each row Select from list |

| Period From / To | The range , expressed as from/to , in the period type measure. When multiple rows are present, the periods cannot overlap. | 1 - 90 91 - 180 | Required for each row Numeric |

| Interest | The interest rate that is to apply for the specified period. | 5 | Required for each row Numeric—percent |

| Description | |||

| Charges Section | |||

| Charges | Select a charge from the Charges list and click Add. If more charges apply to the fixed deposit product, select additional charges and click Add for each. | ||

| Accounting Section | |||

| Accounting | Select one from:

If Cash is selected, see additional fields. | ||

...