About Loan Accounts

A loan account is an instance of a loan product. A loan account has a unique account number, a specified interest rate, and it is owned by one, and only one, client or group.

A loan account can be created for an active client or group based on a loan product that is active on the Submitted Date. When a loan account is created, it inherits the rules and defaults from the loan product. Your financial institution may allow some of the inherited information to be modified for a loan account, depending on how the loan product is defined.

A client may have multiple simultaneous loan accounts within the financial institution's policies, defined in the Product Mix.

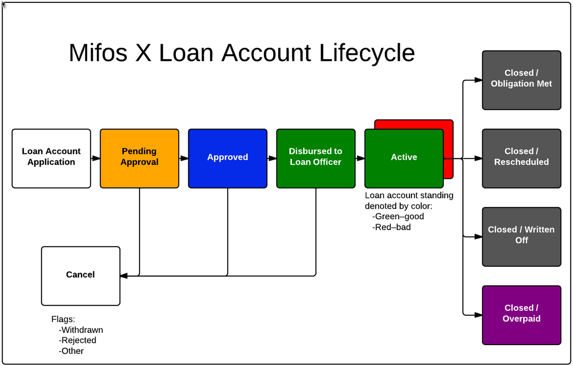

The loan account lifecycle is illustrated in the Mifos X Loan Account Lifecycle diagram. Loan account states are visually indicated in Mifos X using the color scheme illustrated in the Mifos X Loan Account Lifecycle diagram.

Figure Mifos X Loan Account Lifecycle

The loan account actions / transactions availability and affect on the loan account lifecycle state are:

| Previous State | Action / Transaction | Resulting State |

|---|

| N/A | Add Loan | Pending Approval |

| Pending Approval | Add Loan Charge Approve Modify Application Reject Assign Loan Officer Withdrawn by client Delete Add Collateral Guarantor Loan Screen Reports | Pending Approval Approved Pending Approval Cancel (Rejected) Pending Approval Cancel (Withdrawn) N/A Pending Approval Pending Approval Pending Approval |

| Approved | Assign Loan Officer Disburse Disburse to Savings Undo Approval Add Loan Charge Guarantor Loan Screen Reports | Approved Active Active Pending Approval Approved Approved Approved |

| Active | Add Loan Charge Make Repayment Undo Disbursal Waive Interest Write-Off Close (as Rescheduled) Close Loan Screen Reports | Active Active Approved Active Closed (Written Off) Closed (Rescheduled) Closed (Obligation Met) or Closed (Overpaid) Active |

An active loan account in good standing is indicated by a green status. A active loan account that is not in good standing is indicated by a red status.

Group Loan Accounts

There are two main types of loan account for groups: a group loan and a joint liability group (JLG) loan.

Group Loan account: If the group wants take a loan (as group one loan) and do not want track how the loan is spitted between (among)the group members and as group repayment is collected. In this case only one loan account is created against the particular group. ( This is feature is useful for Bank linkage programs, where Nationalized Banks provide loan to a group rather than to member and as group need to repay the loan ex: SHGs)

JLG loan account: In JLG loan application, a loan is created for each member of that group (one can exclude members if member is not applied for new loan) and tracked at member level only. And only these JLG loans appear in the collection sheet. This is feature is useful for organization following Grameen or similar methodology (center, group and joint liability loans)

It is similar to the individual loan but individual loan does not appear in the collection sheet.

Loan Repayment

Mifos X enables individual and group processes for loan repayment.

Individual loan repayments are recorded against one loan account at time using the Make Repayment transaction. Individual loan repayments may also be made by transferring funds from a Saving account to a Loan account based on an active standing order.

Group repayment processes leverage the collection sheet. expects repayments on group meeting dates and