Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

About Loan Accounts

A loan account is an instance of a loan product. A loan account has a unique account number, a specified interest rate, and it is owned by one, and only one, client or group.

A loan account can be created for an active client or group based on a loan product that is active on the submitted date. When a loan account is created, it inherits the rules and defaults from the loan product. Your financial institution may allow some of the inherited information to be modified for a loan account, depending on how the loan product is defined.

| Note |

|---|

Existing loan accounts are unaffected when the loan product they are based upon is changed. |

A client may have more than one active loan account as defined by a financial institution's policies, configured in the Product Mix.

| Note |

|---|

In the case of a group loan application, individual client loan accounts belonging to members of the group are included for the purposes of applying product mix rules. |

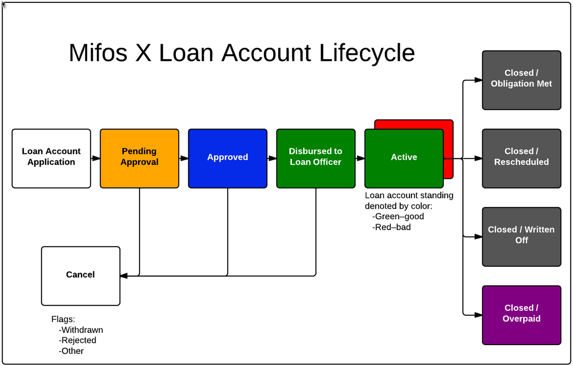

The loan account lifecycle is illustrated in the Mifos X Loan Account Lifecycle diagram. Loan account statuses are visually indicated in Mifos X using the color scheme illustrated in the Mifos X Loan Account Lifecycle diagram.

Figure Mifos X Loan Account Lifecycle

The loan account actions / transactions availability and affect on the loan account lifecycle status are:

| Previous status | Action / Transaction | Resulting status |

|---|---|---|

| N/A | Add Loan | Pending Approval |

| Pending Approval | Pending Approval | |

Approved | ||

Pending Approval | ||

Cancel (Rejected) | ||

Pending Approval | ||

Cancel (Withdrawn) | ||

N/A | ||

Pending Approval | ||

Pending Approval | ||

| Approved | Approved | |

| Active | ||

| Active | ||

| Pending Approval | ||

| Approved | ||

| Guarantor | Approved | |

| Active | Active | |

| Make Repayment | Active if balance owing is greater than zero Closed (Obligation Met) or Closed (Overpaid) if balance is equal or less than zero | |

| Undo Disbursal | Approved | |

| Waive Interest | Active | |

| Write-Off | Closed (Written Off) | |

| Close (as Rescheduled) | Closed (Rescheduled) | |

Closed (Obligation Met) or Closed (Overpaid) |

| Note |

|---|

An active loan account in good standing is indicated by a green status. A active loan account that is not in good standing is indicated by a red status. |

Group Loan Accounts

There are two main types of loan account for groups: a group loan and a joint liability group (JLG) loan.

Group Loan account: A group loan account is a single loan account shared by all members of a group. Members of the group are jointly responsible for repaying the loan. The group is treated collectively by the financial institution as a single entity. This is feature is useful for Bank linkage programs, where nationalized financial institutions provide loans to a group rather than to members, for example, SHGs.

JLG (Joint Liability Group) loan account: A JLG loan account belongs to an individual client who is a member of a group. The client who holds the loan account has primary responsibility for repaying the loan, but the group, in effect, guarantees the loan. This is feature is useful for financial institutions that follow the Grameen, or similar, methodology (center, group, and joint liability group loans). JLG loan accounts are similar to an individual loan account, but individual loan accounts do not appear in the collection sheet.

Loan Account View / Navigation

(**under construction**)

Loan Account Repayment

Mifos X enables individual and group processes for loan account repayment.

Individual repayment processes allow client, group, and JLG loan account repayments to be recorded against one loan account at time. These payments may be made through:

- repayment of cash or similar negotiable payment type

- one-time transfer of funds from a Saving account to a Loan account

- standing instructions to transfer funds from a Saving account to a Loan account on a defined schedule

Group repayment processes are available for group and JLG loans. The group processes leverage the collection sheet, which is a bulk processing methodology for group and joint liability group loans repayments.

When a loan has been repaid in full, regardless of the the payment method, its status will be changed from Active to Closed (obligations met).

For loan account repayment see:

- How to make repayments on a Client Loan Account

- How to make repayments on a group loan account

- How to make repayments on a JLG loan account

| Panel | ||||||||

|---|---|---|---|---|---|---|---|---|

On this page:

|

Related articles

| Filter by label (Content by label) | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|