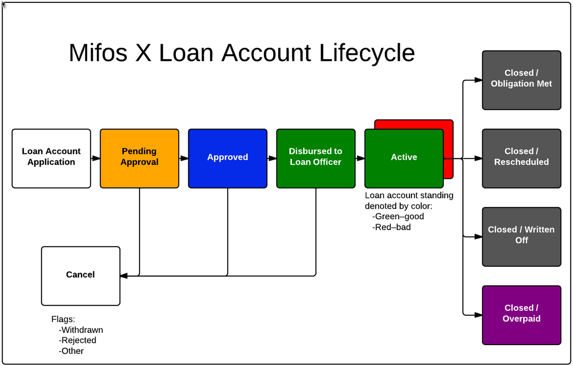

The loan account lifecycle is illustrated in the Mifos X Loan Account Lifecycle diagram. Loan account

statuses are visually indicated in Mifos X using the

colour scheme illustrated in the Mifos X Loan Account Lifecycle diagram.

Figure Mifos X Loan Account Lifecycle

The loan account actions/transactions availability and affect on the loan account

life cycle status are:

| Previous |

|---|

| status | Action/Transaction | Resulting |

|---|

| status | ||

|---|---|---|

| N/A | Add Loan | Pending Approval |

| Pending Approval | Pending Approval | |

Approved | ||

Assign Loan Officer

Withdrawn by client

Delete

Add Collateral

Guarantor

Loan Screen Reports

Pending ApprovalPending Approval |

Approved

Cancel (Rejected) | ||

Pending Approval | ||

Cancel (Withdrawn) | ||

N/A | ||

Pending Approval |

Pending Approval | ||

| Approved | Approved | |

| Active | ||

| Active | ||

| Pending Approval | ||

| Approved | ||

| Guarantor |

| Approved | ||

| Active | Active |

Pending Approval

Approved

Approved

Approved

Add Loan Charge

Make Repayment

Undo Disbursal

Waive Interest

Write-Off

Close (as Rescheduled)

Close

Loan Screen Reports

Active

Active

Approved

Active

Closed (Written Off| Prepay Loan | Active if balance owing is greater than zero Inactive (Obligation Met) or Closed (Overpaid) if balance is equal or less than zero | |

| Make Repayment | Active if balance owing is greater than zero Closed (Obligation Met) or Closed (Overpaid) if balance is equal or less than zero | |

| Undo Disbursal | Approved | |

| Waive Interest | Active | |

| Write-Off | Closed (Written Off) | |

Closed (Rescheduled) | ||

| Close | Closed (Obligation Met) or Closed (Overpaid) |

| Panel | ||||||

|---|---|---|---|---|---|---|

| ||||||

|

| Note |

|---|

An active loan account in good standing is indicated by a green status. A active loan account that is not in good standing is indicated by a red status. |

Group Loan Accounts

There are

three main types of loan account for groups: a group loan

, a joint liability group (JLG) loan and a Bulk JLG loan for a group.

Group Loan account:

A group loan account is a single loan account shared by all members of a group. Members of the group are jointly responsible for repaying the loan. The group is treated collectively by the financial institution as a single entity. This feature is useful for Bank linkage programs, where

nationalized financial institutions provide loans to a group rather than to

members, for example, SHGs.

JLG (Joint Liability Group) loan account:

A JLG loan account belongs to an individual client who is a member of a group. The client who holds the loan account has primary responsibility for repaying the loan but the group in effect guarantees the loan. This feature is useful for financial institutions that follow the Grameen or similar methodology (center, group and joint liability group loans)

. JLG loan accounts are similar to

an individual loan account, but individual loan

accounts do not appear in the collection sheet.

Bulk JLG Loan Account: A Bulk JLG loan account provides an interface to apply a JLG loan to multiple clients in a group. On the client level, it is same as JLG loan account. It is kept to be used in the scenarios when it is required to add a JLG loan to multiple clients with the same Loan Product. Although the functionality to modify the loan details is also provided so that loan data can be modified for any specific client. There are some specific fields like oan officer, submitted date that are kept common for all the clients and few other fields are kept specific to provide the flexibility in modifying the data of a specific client loan.

Prepay The Loan:

Prepaying the loan enables each client to prepay it all at once before the maturity date. On prepaying, client will pay remaining principal amount and interest before maturity date and after that client loan account will be closed.

Loan Account Repayment

Mifos X enables

individuals and groups to process for loan account repayment.

Individual repayment processes allow client, group and JLG loan account repayments

to be recorded against one loan account at time

. These payments may be made through:

- repayment of cash or similar negotiable payment type.

- one-time transfer of funds from a Saving account to a Loan account.

- standing instructions to transfer funds from a Saving account to a Loan account

- on a defined schedule.

Group repayment processes are available for group and JLG loans. The group processes leverage the collection sheet, which is a bulk processing

methodology for group and joint liability group loans repayments

.

When a loan has been repaid in full regardless of the the payment method, its status will be changed from Active to Closed (obligations met).

For loan account repayment see:

- How to make repayments on a Client Loan Account

- How to make repayments on a group loan account

- How to make repayments on a JLG loan account

- How to prepay the loan on a Client Loan Account

| Note |

|---|

Existing loan accounts are unaffected when the loan product they are based upon is changed. |

A client may have more than one active loan account as defined by a financial institution's policies, configured in the Product Mix.

| Note |

|---|

In the case of a group loan application, individual client loan accounts belonging to members of the group are included for the purposes of applying product mix rules. |

Related articles

| Filter by label (Content by label) | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|