Client Accounts

Introduction

As either individuals or as members of groups, clients are the end beneficiaries of microfinance services. Clients are typically recruited, assigned to and managed by a loan officer at a particular BO. If they belong to a group, they inherit the loan officer from the group.

Before clients can receive loans, set up savings accounts, or be charged fees, client accounts must be created for them in Mifos.

Users with appropriate permissions can create a new client record by clicking the Create new client link on the Quick start navigation pane of the Home tab.

Note the following

- Periodic and one-time center fees can be pre-defined from the Admin tab. These can be defined to be automatically charged to any newly created center, appearing on the "Client Charges" page. An LO can remove one or more of these fees for a particular center account and edit the fee amount if it is a one-time fee. If a fee is removed from one account, it does not affect other accounts. In addition, an LO can apply pre-defined fees as well as miscellaneous fees or penalties on the account after it's been created. These charges will be added in the next payment.

- At the same time, up to three savings accounts that can be automatically created for the client. The accounts are created when the client is moved into active state.

Attributes for Client Accounts

The following table of client attributes is divided into three sections: personal information, available during creation of a client record; MFI related information, available during creation of a client record; attributes/actions that are viewable and editable only after creation from the client account details page.

Attributes marked mandatory for Partial state in the table are the minimum requirements to create a record. Pending Approval is an optional state; if this state is hidden, the attributes marked mandatory for Pending state should be considered mandatory for the Active state. Note: We have not thoroughly tested Mifos with the "Pending Approval" state hidden. We do not recommend hiding this state.

| S. No. | Attribute Name | Data Type | Default | Mandatory for State Partial / Pending | Editable after Approved | Partial / Pending/ Approved | Range | Can be hidden by MFI? | Mandatory / Configurable | Description / Notes | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Personal Information | ||||||||||||

| 1. | Salutation | Drop-Down | None | Yes | Yes | Yes / Yes / Yes | Options defined by HO | No | Optional | |||

| 2. | First Name | Alphanumeric | None | Yes | Yes | Yes / Yes / Yes | 100 characters | No | Mandatory | For details, see Name. | ||

| 3. | Middle Name | Alphanumeric | None | No | No | Yes / Yes / Yes | 100 characters | Yes | Optional | |||

| 4. | Second last | Alphanumeric | None | No | No | Yes / Yes / Yes | 100 characters | Yes, if optional | Configurable | |||

| 5. | Last Name | Alphanumeric | None | Yes | Yes | Yes / Yes / Yes | 100 characters | No | Mandatory | |||

| 6. | Government ID # | Alphanumeric | None | Yes | Yes | Yes / Yes / No | N/A | No | Configurable | This can be Government ID, or National ID, or Social Security Number. This is un-editable after a client enters Active state. | ||

| 7. | Date of Birth | Date | None | Yes | Yes | Yes / Yes / Yes | Any date in the past | No | Mandatory | Date format is locale specific, but is stored in MFI format. | ||

| 8. | Gender | Drop-down | None | Yes | Yes | Yes / Yes / Yes | Male; Female | No | Mandatory | |||

| 9. | Marital Status | Drop-down | None | No | No | Yes / Yes / Yes | Options defined by MFI | No | Mandatory | |||

| 10. | Number of children | Numeric | None | No | No | Yes / Yes / Yes | 0-30 | No | Configurable | |||

| 10. | Citizenship | Drop-down | None | No | No | Yes / Yes / Yes | Options defined by MFI. | Yes, if optional | Configurable | |||

| 11. | Ethnicity | Drop-down | None | No | No | Yes / Yes / Yes | Options defined by MFI. | Yes, if optional | Configurable | |||

| 12. | Education level | Drop-down | None | No | No | Yes / Yes / Yes | Options defined by MFI. | Yes, if optional | Configurable | |||

| 13. | Business Activities | Drop-down | None | No | No | Yes / Yes / Yes | Options defined by MFI | Yes, if optional | Configurable | |||

| 14. | Handicapped | Drop-down | None | No | No | Yes / Yes / Yes | Options defined by MFI. | Yes, if optional | Configurable | MFI can make this yes/no, or this can be “blind” “deaf” “wheelchair”, etc. | ||

| 15. | Photograph | Photo | No | No | No | Yes / Yes / Yes | N/A | Yes, if optional | Configurable | For details, see Photograph. | ||

| 16. | Spouse /Father First Name | Alphanumeric | None | Yes | Yes | Yes / Yes / Yes | N/A | No | Configurable | For details, see Name. | ||

| 17. | Spouse /Father Middle Name | Alphanumeric | None | No | No | Yes / Yes / Yes | 200 characters | Yes | Optional | |||

| 18. | Spouse /Father Second Last Name | Alphanumeric | None | No | No | Yes / Yes / Yes | 60 characters | Yes, if optional | Configurable | |||

| 19. | Spouse /Father Last Name | Alphanumeric | None | Yes | Yes | Yes / Yes / Yes | 60 characters | No | Configurable | |||

| 20. | Flag for whether /not father or spouse name | Drop-Down | None | Yes | Yes | Yes / Yes / Yes | Father or Spouse | No | Configurable | |||

| 21. | Address 1 | Alphanumeric | None | Yes | Yes | Yes / Yes / Yes | N/A | No | Mandatory | First field | ||

| 22. | Address 2 | Alphanumeric | None | No | No | Yes / Yes / Yes | N/A | No | Optional | Second field | ||

| 23. | Address 3 | Alphanumeric | None | No | No | Yes / Yes / Yes | N/A | Yes | Optional | Third field | ||

| 24. | City | Alphanumeric | None | Yes | Yes | Yes / Yes / Yes | N/A | No | Configurable | |||

| 25. | State | Drop down | MFI state | Yes | Yes | Yes / Yes / Yes | Defined by MFI | No. | Configurable | |||

| 26. | Country | Alphanumeric | Country of the MFI | Yes | Yes | Yes / Yes / Yes | Defined by MFI. | Yes. | Configurable | |||

| 27. | Postal Code | Numeric | None | Yes | Yes | Yes / Yes / Yes | None | No | Configurable | Label should be defined by MFI: “pin code”, etc. | ||

| 28. | Telephone | Alphanumeric | None | No | No | Yes / Yes / Yes | N/A | Yes, if optional | Configurable | MFI configures whether or not it is mandatory. | ||

| 29. | Question Groups | None | No | Yes | Yes / Yes / Yes | N/A | Yes, if optional (Unused ones) | Configurable | See Question Groups. | |||

| Family Details | ||||||||||||

| 30. | Relationship | Drop-down | None | Yes | Yes | Yes/Yes/Yes | Spouse; Father; Mother; Child | No | Configurable | |||

| 31. | First Name | Alphanumeric | None | Yes | Yes | Yes/Yes/Yes | 100 characters | No | Configurable | |||

| 32. | Middle Name | Alphanumeric | None | No | Yes | Yes/Yes/Yes | 100 characters | No | Configurable | |||

| 33. | Last Name | Alphanumeric | None | Yes | Yes | Yes/Yes/Yes | 100 characters | No | Configurable | |||

| 34. | Date of Birth | Date | None | Yes | Yes | Yes/Yes/Yes | Any date in the past | No | Configurable | |||

| 35. | Gender | Drop-down | None | Yes | Yes | Yes/Yes/Yes | Male; Female | No | Configurable | |||

| 36. | Living Status | Drop-down | None | Yes | Yes | Yes/Yes/Yes | Together; Not Together | No | Configurable | |||

MFI Related Information | ||||||||||||

| 37. | Loan Officer Assigned | Drop down | LO entering record | No | Yes | Yes / Yes / Yes | List of active LOs in the system. | No | Mandatory | If client is part of a group, LO should be inherited from group membership. Else, LO can be chosen from the list of LOs. If the user is an LO, the field should default to the LO’s name | ||

| 38. | Meeting Schedule | Date/ Time/ Recurrence | Inherited from Group | Yes | Yes | Yes / Yes / Yes | 999 weeks; 999 months. | No | Optional | This value is inherited from group information. If not belonging to a group, the client has an individual meeting schedule, which can be changed anytime in any state except for Closed and Cancelled states. For details, refer Meetings | ||

| 39. | Trained | Check box | Not selected | No | No | Yes / Yes / Yes | N/A | Yes, if optional | Optional | See Trained. | ||

| 40. | Trained On | Date | None | No | No | Yes / Yes / Yes | N/A | Hidden, if “Trained” box is hidden | Optional | See Trained. | ||

| 41. | Recruited by | drop-down list | None | No | No | Yes / Yes / Yes | N/A | No | Mandatory | See Recruited by. | ||

| 42. | Branch | Alphanumeric | Branch of the user | Yes | Yes | Yes / Yes / Yes | Branches in the data scope of the logged in user. | No | Mandatory | Default value for this field should be derived from the login of the user/LO. Branch is chosen at the time of client record creation. If the client belongs to a group, the branch of the group is selected. | ||

| 43. | Apply fee type | Multi select | None | No | No | N/A - N/A - N/A | All fee types applicable to clients | No | Optional | Personnel can apply fee amount after choosing an appropriate fee type. For details, refer Client Accounts. This can be edited later on from the ''Client Details ''page. In addition, “default fees” is applicable to all the new client records. If required, users can remove these default fees from a client record. | ||

| Attributes /Actions Viewable /Editable After Client Creation | ||||||||||||

| 44. | Client Start Date | Date | Date when changing the client state to Active. | No | Yes | No / No / No | No | N/A | This is the point at which client is first Approved. | |||

| 45. | Record creation date | Date | N/A | Yes | Yes | No / No / No | N/A | No | N/A | This is system generated when the record was first saved in the Mifos system. | ||

| 46. | Client - system ID | Alphanumeric | None | N/A | N/A | No / No / No | No | N/A | This is an independent unique ID generated by the Mifos system to identify a client. This is not editable. | |||

| 47. | Assigned to group- Group ID | Group ID number | None | No | No | Yes / Yes / Yes | Groups that exist in the branch | No | N/A | Group ID of the group that the client is a part of. | ||

| 48. | Accounts | Account IDs | N/A | N/A | N/A | Yes / Yes / Yes | Accounts owned by the individual | No | N/A | List of loan, savings and client account of the client. | ||

| 49. | Center membership | Center ID | Inherited from Group | No | No | Yes / Yes / Yes | No (If Centers exist in hierarchy) | Mandatory (if existing in hierarchy and client belongs to a group) | Inherited from group details. Clients cannot belong to a center directly. | |||

| 50. | Historical data | Alphanumeric/ Numeric/ Date | None | No | No | Yes / Yes / Yes | N/A | No | Optional | Client’s historical data has to be maintained and displayed in the client details screen. For details, refer Historical Data. | ||

| 51. | Notes (500) | Alphanumeric | None | No | No | Yes / Yes / Yes | N/A | No | Optional | A record can have multiple "notes" attached to it. By default, last three notes are visible in the details page. Also if the “See all notes” link is called, all notes related to the record should be shown. | ||

| 52. | Status | Drop-down | None | N/A | N/A | Yes / Yes / Yes | Partial Application; Pending Approval (optional state); Active; On Hold; Cancelled; Closed | Pending Approval can be hidden by HO | Mandatory | |||

| 53. | Flag | Drop-down | None | No | No | N/A - N/A - N/A | For Status Cancelled-Rejected; Duplicate; Withdrawn; Blacklisted; Other For status Closed- Transferred; Duplicate; Blacklisted; Left Program; Other | No | The flag is required only for Cancelled and Closed statuses. | For details, see flags | ||

| 54. | Client Start Date | Date | N/A | N/A | N/A | N/A | N/A | N/A | N/A | This date is generated when Client status is changed to 'Active'. | ||

| Attachments | ||||||||||||

| 55. | File | Alphanumeric | None | No | Yes | Yes/Yes/Yes | 2 MB | No | N/A | Ability to type directory of file to attach. | ||

| 56. | Description | Alphanumeric | None | No | Yes | Yes/Yes/Yes | 60 characters | No | N/A | This field enables to add description of uploaded file. | ||

Note that only the following fields are mandatory for On Hold, Cancelled, and Closed states: First Name, Last Name, DOB, Loan officer, Meeting. Also, fields that cannot be edited after Active state are not editable in Closed and On Hold states either.

Notes on attributes

- Recruited by. The Formed by attribute is an additional attribute required to address the fact that the LO who manages a client may not be the same one who created the client. This field is mandatory in all states and the value cannot be modified once specified. It is displayed in the details and edit pages as read-only information. All active loan officers (both LO and non-LO) in the branch where the client record is being created are listed in a drop down list. This list is not affected by the data scope of the user. The LO assigned to the client is the default.

- Poverty status. This attribute can be used by MFIs to produce reports on the poverty status of its clients. It is required for all states by default, although an MFI can make it optional. The default options, which are available in a drop-down list and can be changed by the MFI, are: Very Poor, Poor, and Non-poor. This attribute is defined at client creation and can be modified at any time from the edit personal information page. The information is labeled Poverty Status and displayed with the client personal information.

- Name. Client, user, father, and spouse names can consist of the following fields: First Name, Middle Name, Second Last, Last Name. The first and last names are mandatory. An MFI can choose whether to collect the middle two; if they aren’t collected, the fields will not be displayed. An MFI specifies the sequence in which the names are displayed. Once defined, names are always displayed in this order, whether in search results, detail pages, or reports. This sequence does not affect how Mifos sorts results, which is as follows:

- First Name (Middle Name, if it exists) Last Name (Second Last Name, if it exists)

- Last Name (Second Last Name, if it exists), First Name (Middle Name, if it exists)

- Addresses. Clients can have multiple addresses.

- Photograph. Client may select picture in one of the following formats: jpg, gif or png. The maximum size of the file is 300kB. Other formats and size more than 300kB are not accepted so error message is displayed. Photograph will be viewed on client details page and may be edited after client's creation.

Client Family details

If this feature is turned on (see Configuration Guide)

- External ID Number. This can be a government ID, national ID, or social security number. It is un-editable after a client enters an Active state. An MFI can choose whether to display this field.

- Client Trained. Training is an MFI-wide setting and indicates whether a client has been trained. It has no correlation to the group training flag. A client can be marked as Trained only once, and only one Training Date is saved per client record. When a client is marked as trained, a training date must be specified. Once the training date is saved, it cannot be edited or re-entered.

- Assigned to Group. This is the ID of the group that the client has been assigned to. This field is visible only if the client is eligible for group-based membership. A client can be added to an existing group and can belong to only one group at a time. If a client belongs to a group, the LO and meeting schedule of the group are inherited by the client. Clients cannot change groups if they have active loans. A client’s group can be closed if all clients in the group are either in Cancelled or Closed state.

- Meeting Day. A client inherits the meeting day from the group. If the client is not part of any group, the client can have an individual meeting schedule. [For details, see Meetings.]

- Fee Type and Miscellaneous Charges. Miscellaneous fees or penalties can be charged to clients and stored in the client accounts. These are one-time charges. Penalties are not charged for overdue fees. In addition, predefined fee types can be applied to the client accounts. [For details, refer Fees.]

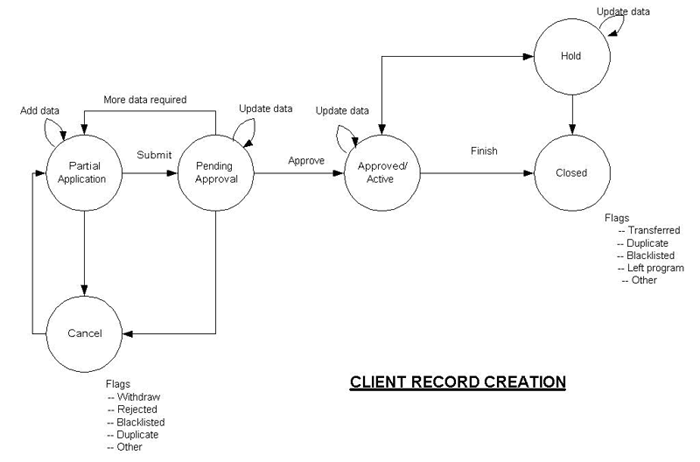

Client Record States

When a client record is created, it is processed through various states, as illustrated below.

A user manually changes a client record state in Mifos. Between state changes a checklist is displayed if one has been defined. Mifos validates the fields as described in the attributes table above. Every change in state is entered in the change log, along with the date and user ID of the user making the change. For details, refer to Change Logs and Application Logs.

As illustrated, a client record can reside in the following states. All states are mutually exclusive:

| Status | Description |

|---|---|

| Partial Application | If the record has been created, but data is incomplete or the user does not want the status to be as Pending Approval, status can be marked as Partial Application. |

| Pending Approval | This is an optional state and can be omitted during setup by the MFI. Record contains all necessary data, and is waiting for approval. Before and after this point, there could be some offline processes, which might govern the approval process. These processes can be specific to each MFI and does not impact Mifos functionality. A record can be saved in this state after the mandatory fields (according to the attributes table) have been filled. |

| Active | Client has been Approved and is eligible to open a savings account or apply for a loan. Every client has to have a Loan Officer to be active. |

| Cancel | A client application can be cancelled due to various reasons: Client can withdraw the application An MFI officer rejects the application The client is not eligible, as the client has been Blacklisted. A duplicate client record already exists and thus the new record is being cancelled. A client can reapply anytime after this. When a client reapplies after the record is Cancelled, the same client record can be moved to Partial state. |

| On Hold | If the client status is marked On Hold, it has the following implications: New accounts cannot be opened for the client. New loan accounts cannot be opened for the client, but repayments for current loans remain as scheduled. |

| Close | A client record can be closed to indicate that the client is not banking with the branch anymore or a duplicate record for the client exists in the system. The flags associated with this state are: Transferred, Duplicate Account, Blacklisted, Left Program, and Other. Once Closed, client can reapply again, but the record creation of the client has to follow the complete application procedure. Refer state flow. |

Notes on client states:

- When a client record is created, it can be either saved in Partial Application state or Pending Approval state. If Pending Approval (an optional state) is not included by the HO, a user with required permissions can save the new client record in Active state.

- An Active client record must have an LO and a meeting time. A client record can be saved in Partial or Pending Approval without an LO assigned or meeting time defined.

- There is no restriction on the number of times a client state can be changed.

- If a client state is changed to Cancelled/Closed, the associations with the LO, group, and meeting remain.

- There is no Deleted state. All client records are kept in the system.

- A blacklisted client can be moved to Active, but a permanent flag gets attached to the client record to indicate that the client has been previously blacklisted. This flag is viewable on the client account details page.

- When a client record is closed, the system stops applying any periodic fee linked to the client record. Transactions can no longer be made to the record. Miscellaneous penalty or any amount due remains.

Client Account Details

Once a user with the appropriate permissions has entered the data to create a client, the user then previews the entire set of information in one screen, to validate the data. This is a mandatory step. When the user approves the preview page, the client’s data is saved in the database. Error checking for mandatory fields and valid data is performed. If any invalid entry is found or any mandatory fields have been left empty, an error message is displayed.

When a client record is created, Mifos checks the system for duplicate records, based on Government ID. If a client record with the same Government ID already exists in any state other than Closed, an error is display and the new record is not created. If a Government ID is not present, the system checks for duplicates based on Name and DOB [and father/spouse name?]. If this information matches an existing record, the user must change the name (for example, by adding a middle name) before the new record is created. In either case, if a matching record is found in Closed state, a warning is displayed to the user to review the existing record before continuing.

The client account details page includes the following information:

- Current accounts for the client

- Closed accounts

- A link to the details page for the group to which the client is assigned

- A link to the details page for the center to which the client is assigned

- MFI information, including training details, group membership, and meeting details for each client

- Personal information

- Associated notes

- Most recent set of transactions.

- A link to summarized historical data

- A link to View change log

- Attached Question Groups

- A link to View Additional Information

All data, except the system-generated Client ID, Government ID, and DOB can be modified. Government ID and DOB fields can only be modified in Partial Application state. A client’s group membership can be edited or removed, as long as client doesn't have any active loan or savings accounts. Every time a client record is edited or its state is changed, the user is required to preview the changes before they are saved.

Change logs track the following changes made to the client records: Date of change, Changed by, Fields changed, Old value, New value. These logs are viewable from the client details page. Changes are displayed in a single list on one or more pages.

Historical Data

Historical information is available by clicking the View Summarized Historical Data link at the bottom of the account details page.

- The attributes for historical data given in table below are editable at any time and Mifos system validates these attributes.

- The system allows users to enter details of a single loan only, which is usually the last loan taken by the client or the group.

- None of the fields are mandatory.

- This information is stored for reference purposes only and should be confused with historical data that is migrated into Mifos’ database. Mifos does not use or incorporate this data to update the client record. For example, the loan cycle number listed here is not added to the loan cycle number tracked by Mifos.

- Since most MFIs decide to migrate their data from their legacy system into the Mifos database, we do not expect this feature to be heavily used.

Attribute | Data Type | Remarks |

|---|---|---|

MFI Joining Date | Date | No validations are required. Future or past dates will also be acceptable. |

Loan Cycle Number | Number | |

Product Name | Text field | No validations are required. |

Amount of loan | Numeric | Information on the last loan is stored by the system. |

Total amount paid | Numeric | |

Interest Paid | Numeric | |

Number of missed payments | Numeric | |

Total number of payments | Numeric | |

Notes | Alphanumeric | Only one Notes field is required and this is editable. |

Performance History

Mifos tracks the performance of each client and provides the following metrics, which are displayed on the client’s detail pages in the performance history box.

The following parameters are used to track the performance of each client by the system:

| S. No. | Performance Metrics | Formula | Description |

|---|---|---|---|

| 1 | Loan Cycle number | The counter is incremented when a loan is disbursed if, at loan product definition level [link], the attributeInclude in loan cycle is set to Yes. If the loan account is rescheduled, written off, or cancelled, the loan cycle number is decremented. | |

| 2 | Amount of last loan | Amount of the most recently “closed-obligations met” loan | This consists of the most recently "closed-- obligations met" loan amount that incremented the loan cycle number. Please note that the logic for this field is different on the group page. There is an open issue (#533) to resolve this. |

| 3 | Total # of active loans | Total number of all loan accounts in * Active in good standing * Active in bad standing | |

| 4 | Delinquent Portfolio | Amount of overdue loan principal / Total original value of all outstanding loans | * This should consider loans in Active in good standing and Active in bad standing states. * Written-off loans should not be included. * Closed- rescheduled loans should not be included. |

| 5 | Total Savings | Sum of account balances of all mandatory and voluntary savings accounts | This should include all the savings accounts of the client. |

| 6 | Attendance | Attendance of the client is entered from the Enter Collection Sheet screens. The following two counters should be maintained: * Number of meetings attended: Number of meetings where the client attendance is equal to "Present" and “Late” for the last 12 months * Number of meetings missed: Number of meetings where the client attendance has a value equal to "Absent", "Approved leave" for last 12 months For one meeting, attendance should be counted only once, irrespective of the number of times bulk entry has been entered. | |

| 7 | Loan cycle per product | See description below |

Notes on loan cycle per product

- Separate loan counters for each product are maintained for each client. For example, if the client has taken two agricultural loans and three cattle loans, her performance history displays a loan cycle for educational loan=2; loan cycle for cattle loan=3.

- The counter is incremented when a loan account is approved and decremented for rescheduled loans or written off loans.

- The loan cycle number from historical data is not included in any of the above counters.

Assigning Clients to a Group

New clients can be added to a group by clicking the Add Client link on the group account details page. An individual can belong to only one group at any time.

The following rules apply to the relationship between group states and client states:

- An individual state should be equal to, or behind the state of the group:

- If Group state = Partial Application, the group can have clients who are in Partial state only.

- If Group state = Pending Approval, the group can have clients in Partial Application or Pending Approval states only.

- If Group state = Approved, the group can have clients in Partial Application, or Pending Approval, or Approved or On Hold states.

- If a group is On Hold, the clients are not affected; new clients can be assigned to On Hold groups and client records can be Closed.

- If a group is Active, a client belonging to that group can be Closed.

- If clients are Active, the group cannot be closed before assigning the clients to another group or closing them.

- If clients are in Closed/Cancelled state, the group can be closed.

- If any client in the group is On Hold, the group cannot be closed unless that client is Closed or assigned to another group.

- If a group status is changed from Pending Approval to Cancelled, the system changes the Pending Approval status of any clients of the group to Partial Application.

- Clients in states other than Closed and Cancelled can be assigned a position in the center or the group.

Adding group memberships for existing clients

Existing clients that do not belong to a group can be assigned to a group, as long as their client status is neither closed or cancelled and they do not have an active loan. The group status much be equal to or higher than the client status.

- If the client status is Approved/active or on hold, the client can only be transferred into groups with Approved/active status

- If the client status is pending approval, the client can only be transferred into groups with Approved/active or pending approval status

- If the client status is partial application, the client can only be transferred into groups with Approved/active, pending approval or partial application status

Group membership is assigned via the Edit meeting schedule/Add group link on the client details page. When a group is selected, the system validates that the client does not have an active loan or savings account and adds the client information to the group account details and updates the group performance metrics.

Changes are made to deposits due from the group: if the group’s mandatory savings account is calculated per individual, the amounts are recalculated based n the new number of clients. The client inherits the meeting schedule and the loan officer of the assigned group.

Removing group memberships for existing clients

Group membership for an existing client can be removed. This can be done by clicking the Edit/Remove group membership link.

The user can optionally assign another loan officer at this point, and enter notes about the removal. When the user clicks Submit, the system prompts the user if the client is active and no loan officer was assigned. If the client was a title holder in the group, the system alerts the user that the title position is now empty. The system then removes the group membership from the client record.

After a client is removed from a group, the performance history details on the group details page is updated with the new number of client members and the individual loan size and total loan portfolio fields are recalculated. If the group’s mandatory savings account is calculated per client, the amount is recalculated based on the change in the number of client members.

Moving Clients

A client can be reassigned to any of the following:

- Another group, as long as the client does not have any loan or savings accounts in states other than Cancelled/Closed. When the client is transferred to another group, the LO and meeting schedule are inherited from the new group.

- Another branch, as long as the client’s loan and savings accounts in the current branch are closed or canceled. All the client information is transferred along with the Client System ID. When a client is moved to another branch, the user must select a new loan officer after the client is moved. Please see Issue #1555 in the issue tracker.

- Another LO within the same branch. An independent client (a client that does not belong to a group) can be transferred to another LO within the same branch.

Import Clients from excel file

Mifos provides a functionality to create a large number of clients by automatically importing them from Excel file (.xls format). You can import clients in any states with all necessary information. There is no difference between clients created manually and clients created automatically via import functionality.

Template to create .xls file with clients can be downloaded from here.

Following table provides an explanation of columns in table. Fields with asterisks are mandatory.

Column name | Column description |

|---|---|

Client Global Num* | System ID number by which Client can be identified in Mifos. |

Branch Short Name* | Short name of Branch to which Client should be attached if Group membership if not required. |

Group Global Num* | System ID number of Group to which Client should be attached. |

Salutation* | Allowed values are specified on 'Define Lookup Options' page in Mifos. |

First Name* | First name of Client. |

Middle Name | Client's middle name. |

Last Name* | Last name of Client. |

Second Last Name | Second last name of Client. |

Government ID | Additional ID field. |

Date of Birth* | Client's birth date. |

Gender* | Allowed values are:

|

Marital Status | Allowed values are specified on 'Define Lookup Options' page in Mifos. |

Number of Children | Number of children. |

Citizenship | Allowed values are specified on 'Define Lookup Options' page in Mifos. |

Ethnicity | Allowed values are specified on 'Define Lookup Options' page in Mifos. |

Education Level | Allowed values are specified on 'Define Lookup Options' page in Mifos. |

Activities | Allowed values are specified on 'Define Lookup Options' page in Mifos. |

Poverty Status | Allowed values are:

|

Handicapped | Allowed values are specified on 'Define Lookup Options' page in Mifos. |

Spouse/Father Relationship | Allowed values are:

|

First Name | Spouse/Father's first name. |

Middle Name | Spouse/Father's middle name. |

Second Last Name | Spouse/Father's second last name. |

Last Name | Spouse/Father's last name. |

Address | Client's address. |

City/District | Client's City/District. |

State | Client's State. |

Country | Client's Country. |

Postal Code | Client's Postal Code. |

Telephone | Client's telephone number. |

Recruited By | Name and Last name of person who recruited Client. |

Status | State in which Client should be created. Allowed values are:

|

Loan Officer assigned | Name and Last name of Loan Officer. |

Frequency of meetings | Allowed values are:

|

Recur every (week) | Frequency of weeks. |

On (week) | Day of week. Allowed values are:

|

Day (month) | Day of month. |

Every (month) | Frequency of months. |

The (month) | Allowed values are:

|

Day (month) | Day of month. Allowed values are:

|

Every (month) | Frequency of months. |

Location of meeting* | Place of meeting. |

Activation Date | Date of customer activation. |

Note: It is possible to sort client's fields and put them in the order which is most suitable for user.