Group Accounts

In Mifos, clients can be organized into groups. If Mifos is configured to support centers, then groups are associated with centers and inherit the meeting schedule and loan officer from the center. If Mifos is configured not to support centers, then groups are the top of the client hierarchy and a meeting schedule and loan officer must be defined for the group.

A group may have no clients, one client, or many clients. Clients can be added to a group either at the time of client account creation or at a later time.

The role of the group varies depending on the MFI. For some, the group is the primary unit with which the MFI interacts. Groups maintain a single group savings account and receive a single group loan from the MFI. For other MFIs, the group is simply a collection of individual clients. The benefits of the group include:

- By vouching for other members of the group, the group provides due diligence of creditworthiness.

- By co-signing the loan, the group provides insurance of payment by individuals.

- The group provides reinforcement, esprit de’ corps, encouragement.

When a group applies for a group loan, the loan application goes through the same approval cycle as an individual loan.

The MFI can assign members positions such as president and treasurer, to facilitate group management.

Group Fees

Group fees can be defined from the Admin tab. A user can remove one or more of these fees for a particular group account. If a fee is removed from one account, it does not affect other accounts. In addition, an LO can apply miscellaneous fees or penalties, either at the time of account creation or later. The LO specifies the amount, which is added in the next payment. These are one-time charges; a penalty cannot be charged for an overdue fee.

Attributes for group records

The following table of group attributes is divided as follows: attributes related to groups, available during group creation; attributes related to the MFI, available during group creation; and attributes and actions that can be viewed/edited only after group creation, from the 'group Details page.

Attributes marked as Mandatory for Partial state in the table below are the minimum required to create a record. Pending Approval is an optional state; if Mifos is configured to hide this state, the attributes marked as Mandatory for Pending in the table should be considered as Mandatory for the Active state. Note: We have not thoroughly tested Mifos with the "Pending Approval" state hidden. We do not recommend hiding this state.

| S.No. | Attribute Name | Data Type | Default value | Mandatory for State = Partial/ Pending/ Partial | Editable After State= Pending/ Approved | Range | Can be hidden? | Mandatory/ Configurable | Description/ Notes |

|---|---|---|---|---|---|---|---|---|---|

Group Information | |||||||||

| 1. | Name of Group | Alphanumeric | None | Yes/Yes/Yes | Yes/Yes | N/A | No | Mandatory | This must be unique across the branch. |

| 2. | Address of Group - Address 1 | Alphanumeric | None | No/No/Yes | Yes/Yes | N/A | Yes, if optional | Configurable | First field. The complete address of the group can be hidden. |

| 3. | Address 2 | Alphanumeric | None | No/No/Yes | Yes/Yes | N/A | Yes | Optional | Second field |

| 4. | Address 3 | Alphanumeric | None | No/No/Yes | Yes/Yes | N/A | Yes | Optional | Third field |

| 5. | City | Alphanumeric | None | No/No/Yes | Yes/Yes | N/A | Yes, if optional | Configurable | |

| 6. | State | Alphanumeric | State of MFI | No/No/Yes | Yes/Yes | Defined by MFI | Yes, if optional | Configurable | |

| 7. | Country | Alphanumeric | Country of MFI | No/No/Yes | Yes/Yes | Defined by MFI | Yes, if optional | Configurable | |

| 8. | Postal Code | Alphanumeric | None | No/No/Yes | Yes/Yes | N/A | Yes | Optional | |

| 9. | Telephone | Alphanumeric | None | No/No/Yes | Yes/Yes | N/A | Yes, if optional | Configurable | |

| 10. | Question Groups | None | No/No/Yes | Yes/Yes | N/A | Yes, if optional | Configurable | See Question Groups. | |

MFI Related Information | |||||||||

| 11. | LO assigned to group | Drop -Down | None | No/No/Yes | Yes/Yes | LOs active in the branch. | No | Mandatory | LO is inherited from the center, if Mifos is configured with centers enabled. Field is disabled in UI, if centers are enabled. |

| 12. | Name of Center assigned | Click and select | None | No/No/Yes | Yes/Yes | Available centers, if Centre hierarchy exists. | No | Mandatory to be approved if Center hierarchy exists. | This field applies on if Mifos is configured with centers enabled. Center is chosen at the time of group creation. |

| 13. | Trained | Checkbox | None | No/No/Yes | Yes/Yes | Selected/Not selected. | Yes | Optional | Once selected, it cannot be cleared. For details, see Trained. |

| 14. | Trained on | Date | None | No/No/Yes | Yes/Yes | N/A | Yes, if “Trained” is hidden. | Mandatory, if group is marked as “Trained”. | Once the Trained on date is saved, it cannot be changed. The field becomes read-only. |

| 15. | External ID | Alphanumeric | None | No/No/Yes | Yes/Yes | N/A | Yes, if optional | Configurable | If an old system was being used, and now being transferred to Mifos system, this can serve as a link between old system and Mifos system. There is no built-in intelligence in Mifos system to handle this data. |

| 16. | Branch Name | Alphanumeric | Branch of User | Yes/Yes/Yes | Yes/Yes | Braches as per data scope of logged in user | No | Mandatory | If Mifos is configured with centers enabled, the branch is inherited from the center. If centers are not enabled, then system should display a list of branches per user's data scope. |

| 17. | Meeting Schedule - Location of group meeting | Alphanumeric | None | No/No/Yes | Yes/Yes | N/A | No | Mandatory | If Mifos is configured with centers enabled, the meeting is inherited from the center. If centers are not enabled, then the meeting schedules for the group must be defined. |

| 18. | Meeting Schedule – Frequency of Meetings | Date/T ime/ Recurrence | Inherited from center | No/No/Yes | Yes/Yes | 999 weeks; 999 months | No | Optional | Same as 17 above. |

| 19. | Additional/Administrative fee type | Multi select | None | No/No/N/A | N/A - N/A | All fee types applicable to clients | No | Optional | See Group Fees. |

Attributes/Actions Viewable/Editable After Group Creation | |||||||||

| 20. | Assign client ID – | Un-editable | None | No/No/Yes | Yes/Yes | Clients belonging to the group | No | Clients belonging to the group are listed on the group details page. See Assign Clients to Group | |

| 21. | Assigning clients to positions (Officer titles/positions) | Drop-Down | None | No/No/Yes | Yes/Yes | Options defined by MFI | Yes, if optional | Configurable | See ''__Officer Titles; ''Assign Clients to Positions__ |

| 22. | Group System ID | Alphanumeric | N/A | N/A - N/A - N/A | N/A - N/A | N/A | No | Mandatory | System generated unique ID. This is not editable. |

| 23. | Record creation date | Date | None | Yes/Yes/No | No/No | N/A | No | Mandatory | Date when the record was first saved in the system. |

| 24. | Historical data | Alphanumeric/ Numeric/ Date | None | No/No/Yes | Yes/Yes | N/A | No | Optional | Refer Historical Data under Client Accounts |

| 25. | Notes (500) | Alphanumeric | None | No/No/Yes | Yes/Yes | '''N/A''' | No | Optional | A record can have multiple "notes" attached to it. The last three notes are visible in the ''Details'' page. |

| 26. | Status | Drop-Down | None | N/A - N/A - Yes | Yes/Yes | Refer State flow | Pending Approval can be hidden by HO | ||

| 27. | Flag | Drop-Down | None | No/No/N/A | N/A - N/A | Refer flags | No | The flag is required only for Cancelled and Closed statuses. | |

| 28. | Group approval date | Date | N/A | N/A - N/A - N/A | N/A - N/A | N/A | No | No | Date is recorded after changing Group status to 'Active'. |

Notes on Attributes

- Recruited by. The Formed by attribute is an additional attribute required to address the fact that the LO who manages a group may not be the same as the one who formed the group. This field is mandatory in all states and the value cannot be modified once specified during group creation. It is displayed in the details and edit pages as read-only information. All Active loan officers in the branch where the group is being created are listed in a drop down list. The LO assigned to the group can be the same as the LO who formed the group. The default value is the loan officer assigned.

- Name of Center Assigned. If a center hierarchy exists in the system, groups must be assigned to a center to be approved. Groups inherit the meeting schedule and LO from the center. If a center hierarchy does not exist, the user must define the meeting details for the group. A group's center can be changed, but before that can happen, all loan accounts of the group and the clients must be in a Closed or Cancelled state.

- Group Trained: Training is an MFI-wide setting and the training flag indicates whether a group has been trained. When a group is marked as Trained, a Training Date must be specified. A group can be marked as Trained only once and only one Training Date is saved per group record. Once the Training Date is saved, it cannot be edited or re-entered.

- External ID Number: This field can be helpful if the MFI used a different system in the past to transfer data to Mifos. This ID can be used as a link between the old and new systems. Mifos does not hold any logic to handle this field.

- Group Charges: Fee Types and Miscellaneous Charges: Miscellaneous fees or penalties can be charged to groups on the Group Charges page. These are one-time charges and penalties are not charged for overdue fees.

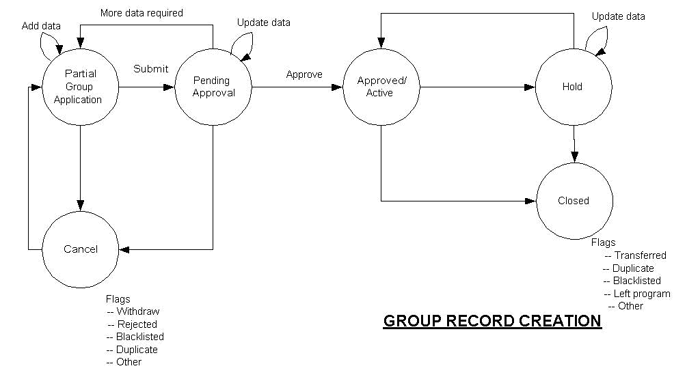

Group record states

When a group record is created, it is processed through various states, as illustrated below. A user with appropriate permissions can manually changes a group record state in Mifos. If a checklist has been defined by the MFI, this checklist will appear when changing the group state [see Checklist].

The state flow diagram explains the various states or statuses that a group record goes through:

As illustrated, a group record can reside in the following states:

state | description |

|---|---|

Partial Group Application | If the record has been created, but data is incomplete or the user does not want the state to be Pending Approval, the status can be marked as Partial Application. |

Pending Approval | This is an optional state and can be hidden by the MFI. The record contains all necessary data, and is waiting for approval. Before and after this point, there may be some offline processes that govern the approval process. These processes are specific to the MFI and do not impact Mifos functionality. |

Approved/Active | The group has been approved and is eligible to open a savings account or apply for a loan or other products offered by the MFI. |

Cancel | A group application can be cancelled due to various reasons: A group can reapply at any time after this. When the group reapplies, the old record and system ID can be used and carried forward if it has not been archived. From Cancel, a group record can be moved to a Partial Application state. |

On Hold | If the group state is marked On hold, it has the following implications: * New accounts cannot be opened for the group. |

Close | A group record can be Closed to indicate that the group is no longer banking with the branch or that a duplicate record for the group exists in the system. The Flags associated with this state are: Transferred, Duplicate Account, Left Program, Blacklisted, and Other. |

- When a group record is created, it can be either saved in Partial Application state or Pending Approval. When Mifos is configured to exclude Pending Approval (an optional state), a new group record can be saved in Active state. [Note: this has not been thoroughly tested and may not work propertly]. There is no restriction on the number of times a group state is changed.

- When a group is closed, any associations with its centers (if applicable) and its clients are retained. Outstanding penalties or amounts due listed in the "Group Charges" section remain attached to the record, although a user can still waive outstanding fees. Users will not be allowed to apply any payments or charge any additional fees to an inactive center.

- If a group is Blacklisted, this does not change the state of its member records or accounts. Once a Blacklisted flag is attached to a group record, it cannot be removed, regardless of the state the group moves to. For example, a Blacklisted group can be moved to Active, but the Blacklisted flag will still be attached to the record and will be viewable on the group account details page.

- A group without clients can exist in any state and have active loan and savings accounts.

- There is no Deleted state. All group records are kept in the system.

Group Account Details

Once a user with appropriate permissions has entered the information to create a group, the user then previews the entire set of information in one screen, to validate the data. This is a mandatory step. When the user approves the preview page, the group’s data is saved in the database. Every time a group record is edited or a state is changed, the user is required to preview the changes before they are saved.

Error checking for mandatory fields and valid data is performed. If an invalid entry is found or any mandatory fields have been left empty, an error message is displayed. The system checks that the group name is unique across the branch, as a way of ensuring that no duplicate records exist. No further checking for duplicate group records is performed.

When a group is created, Mifos generates a unique ID to identify it in the system. This is displayed on the group details page, which also includes the following information:

- Account information: current accounts for each group; closed accounts and account states for each group

- Clients assigned

- Group information: training details, official titles assigned, and meeting details.

- Associated notes

- Historical data, as described in Client Accounts.

- Performance History, described below.

Performance History

Mifos tracks the performance of each group and provides the following metrics, which are displayed in client's and groups’ detail pages in the Performance History box:

performance metrics | formula |

|---|---|

Number of active clients | Total number of Active and On hold clients belonging to the group, irrespective of the client state |

Amount of last group loan if applicable | Total amount of the last group loan that was disbursed. Please note that the logic for this field is different on the client page. There is an open issue (#533) to resolve this. |

Average loan size for individual members | Sum of active loan amount for all client loan accounts / Number of client loan accounts |

Total outstanding loan portfolio | Total original value of all outstanding loans (including group loans and all client loans) |

Portfolio at risk | The remaining balance of all outstanding loans that have one or more installments of principal past due more than 30 days / Outstanding principal value of all outstanding loans. This includes only Loan product loans. These values are principal only; they do not include interest. |

Total Savings | Total of all savings accounts of the group and those of the clients belonging to the group |

Loan cycle per product | See description below* |

Notes on loan cycle per product

- Separate loan counters for each product are maintained for each group. For example, if the group has taken 2 agricultural loans and 3 cattle loans, its performance history displays the loan cycle for educational loan= 2; loan cycle for cattle loan= 3.

- The counter is incremented when a loan account is approved and decremented for rescheduled loans or written off loans.

- The loan cycle number from historical data is not included in any of the above counters.

Moving Groups

A group can be moved from one center to another if all the active loan and savings accounts associated to the group and to the clients within the group are closed. The group can only be moved to a center with the same frequency of meetings as before. For example, a group that meets monthly cannot be moved to a center that meets weekly). When a group is moved, the group and its clients inherit the meeting time and loan officer of the new center. If loan schedules are tied to meetings, then all corresponding loan schedules will be updated.

A group attempting to transfer to a branch already containing a group with the same name must first change its name to something unique to the new branch.

Loan Officers assigned to groups can also be changed.