Loan Accounts

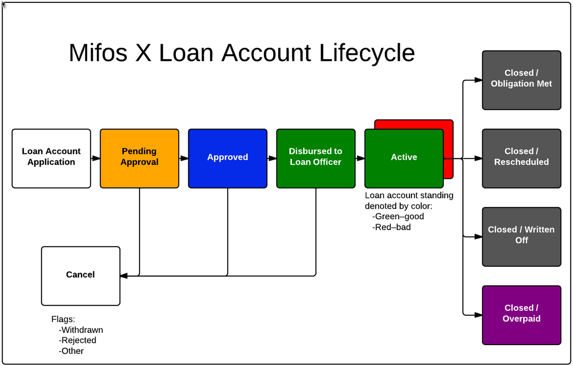

The loan account lifecycle is illustrated in the Mifos X Loan Account Lifecycle diagram. Loan account statuses are visually indicated in Mifos X using the colour scheme illustrated in the Mifos X Loan Account Lifecycle diagram.

Figure Mifos X Loan Account Lifecycle

The loan account actions/transactions availability and affect on the loan account life cycle status are:

| Previous status | Action/Transaction | Resulting status |

|---|---|---|

| N/A | Add Loan | Pending Approval |

| Pending Approval | Pending Approval | |

Approved | ||

Pending Approval | ||

Cancel (Rejected) | ||

Pending Approval | ||

Cancel (Withdrawn) | ||

N/A | ||

Pending Approval | ||

Pending Approval | ||

| Approved | Approved | |

| Active | ||

| Active | ||

| Pending Approval | ||

| Approved | ||

| Guarantor | Approved | |

| Active | Active | |

| Prepay Loan | Active if balance owing is greater than zero Inactive (Obligation Met) or Closed (Overpaid) if balance is equal or less than zero | |

| Make Repayment | Active if balance owing is greater than zero Closed (Obligation Met) or Closed (Overpaid) if balance is equal or less than zero | |

| Undo Disbursal | Approved | |

| Waive Interest | Active | |

| Write-Off | Closed (Written Off) | |

Closed (Rescheduled) | ||

| Close | Closed (Obligation Met) or Closed (Overpaid) |

How to Create a Loan Account Application

How to Make Repayments on a Client Loan Account

Track Loan Performance History

How to Approve a Loan Account Application

How to Add a Charge to a Loan Account

How to Modify a Loan Account Application

How to Assign a Loan Officer

How to Reject a Loan Account Application

How to Withdraw a Loan Account Application

How to Delete a Loan Account Application

How to Add Collateral to a Loan Account

How to Add/Remove/Modify a Guarantor to a Loan Account

How to Manage Loan Account Disbursment

How to Make Repayments on a Group Loan Account

Using collection sheet or other payment types for making payments

How to Waive Interest for a Loan Account

How to Write-off a Loan Account

How to Close a Loan Account as Rescheduled

How to Close a Loan Account

Making Prepay of the loan

How to Prepay a Loan Account

How To Create Group Loan Account

How to Process Bulk JLG Loan Application

How to generate - Loan transactions report

How to reschedule loan

How to provide floating rates

How to provide variable installments

How to create new loan - Interest Recalculation

Tranche loan process

Loan with term vary based on loan cycle

How to Place Guarantee Funds On-Hold?

An active loan account in good standing is indicated by a green status. A active loan account that is not in good standing is indicated by a red status.

Group Loan Accounts

There are three main types of loan account for groups: a group loan, a joint liability group (JLG) loan and a Bulk JLG loan for a group.

Group Loan account: A group loan account is a single loan account shared by all members of a group. Members of the group are jointly responsible for repaying the loan. The group is treated collectively by the financial institution as a single entity. This feature is useful for Bank linkage programs, where nationalized financial institutions provide loans to a group rather than to members, for example, SHGs.

JLG (Joint Liability Group) loan account: A JLG loan account belongs to an individual client who is a member of a group. The client who holds the loan account has primary responsibility for repaying the loan but the group in effect guarantees the loan. This feature is useful for financial institutions that follow the Grameen or similar methodology (center, group and joint liability group loans). JLG loan accounts are similar to an individual loan account, but individual loan accounts do not appear in the collection sheet.

Bulk JLG Loan Account: A Bulk JLG loan account provides an interface to apply a JLG loan to multiple clients in a group. On the client level, it is same as JLG loan account. It is kept to be used in the scenarios when it is required to add a JLG loan to multiple clients with the same Loan Product. Although the functionality to modify the loan details is also provided so that loan data can be modified for any specific client. There are some specific fields like oan officer, submitted date that are kept common for all the clients and few other fields are kept specific to provide the flexibility in modifying the data of a specific client loan.

Prepay The Loan:

Prepaying the loan enables each client to prepay it all at once before the maturity date. On prepaying, client will pay remaining principal amount and interest before maturity date and after that client loan account will be closed.

Loan Account Repayment

Mifos X enables individuals and groups to process for loan account repayment.

Individual repayment processes allow client, group and JLG loan account repayments to be recorded against one loan account at time. These payments may be made through:

- repayment of cash or similar negotiable payment type.

- one-time transfer of funds from a Saving account to a Loan account.

- standing instructions to transfer funds from a Saving account to a Loan account on a defined schedule.

Group repayment processes are available for group and JLG loans. The group processes leverage the collection sheet, which is a bulk processing methodology for group and joint liability group loans repayments.

When a loan has been repaid in full regardless of the the payment method, its status will be changed from Active to Closed (obligations met).

For loan account repayment see:

- How to make repayments on a Client Loan Account

- How to make repayments on a group loan account

- How to make repayments on a JLG loan account

- How to prepay the loan on a Client Loan Account

Existing loan accounts are unaffected when the loan product they are based upon is changed.

A client may have more than one active loan account as defined by a financial institution's policies, configured in the Product Mix.

In the case of a group loan application, individual client loan accounts belonging to members of the group are included for the purposes of applying product mix rules.

Related articles