How to provide floating rates

On this page:

Create loan account - Floating rate

To create a loan account application for a client

To create a loan account application for a client, select the client by searching the desired client from Global Search. Click the General tab.

- On the Client page, Click +New Loan on the bright blue action bar.

- Select the loan product to base the loan account on from the product list.

- Complete the loan account fields, making any modifications from the default that are permitted and applicable to the loan application.

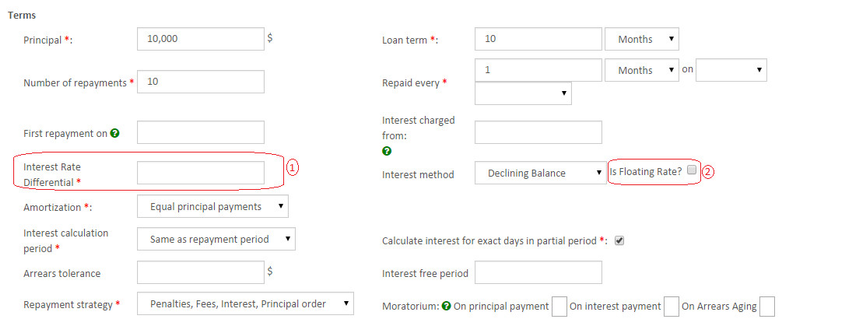

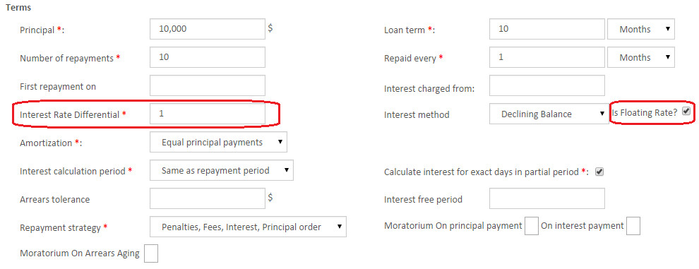

- Update required fields -

a) Interest rate differential - Provide interest rate here.

b) Is Floating Rate - Check the check box to enable floating interest rate.

- If unchecked, the disbursement interest rate will be applied and will remain same throughout the installment.

Refer the example below:

- Click Submit.

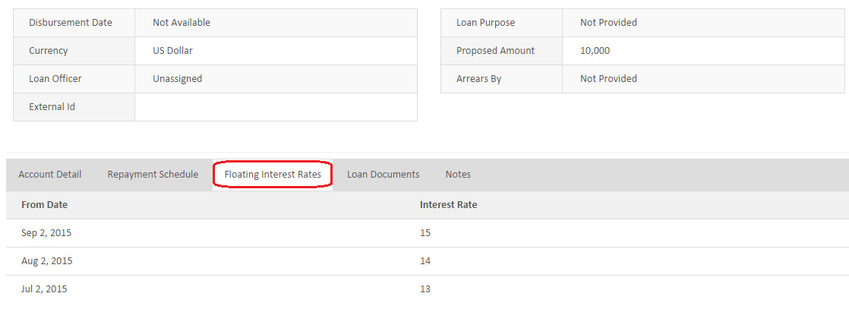

Viewing Loan Product - Applied Floating Rate

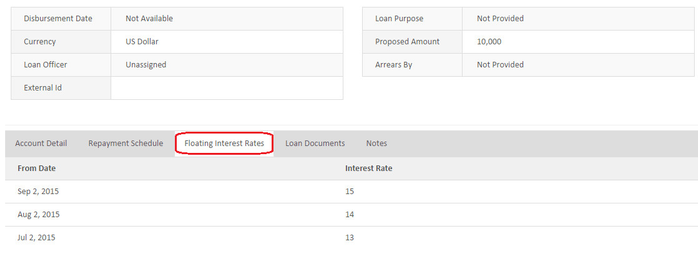

Go to Loan account page >> Floating Interest Rates

Please find below scenarios and configurations for understanding floating rates better:-

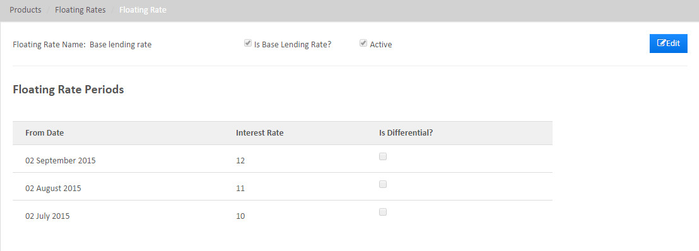

Scenario 1: With Base lending rate

a) Floating Rate definition (Admin>>Product>>Floating Rate)

Base Lending Rate (Checked box) defined as shown in the image below

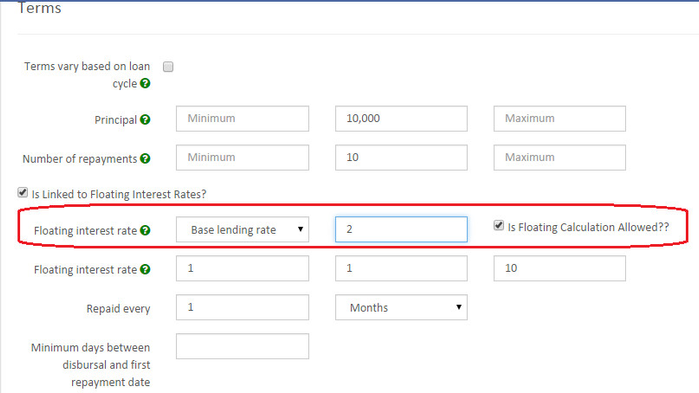

b) Loan Product definition (Admin>>Product>>Loan Product)

In the term section - Selected Floating rate is Base lending rate

- Differential Rate is 2% (Product level)

c) Loan Account definition (Client>>New Loan application)

In term section - Interest Rate differential - 1%

- Is Floating Rate - Enabled (Checked box)

d) In the loan account page >> Floating interest rates

As you could see for the interest rate, i.e

July 2,2015 - 13% = [10(Base interest rate) +2(Loan product level) +1(Loan account level)]

Aug 2,2015 - 14% = [11(Base interest rate) +2(Loan product level) +1(Loan account level)]

Sep 2,2015 - 15% = [12(Base interest rate) +2(Loan product level) +1(Loan account level)]

Note:- For this scenario Is Floating Rate is Enabled (Checked box) at the loan account level.

Scenario 2: Without "Is Floating rate enabled" - Loan account level

Is Floating Rate - Disabled (Unchecked box) then, if the loan was disbursed on July 5th, 2015 then interest rate would be without floating rate.

Like shown below:

July 2,2015 - 13% = [10(Base interest rate) +2(Loan product level) +1(Loan account level)]

Aug 2,2015 - 13% = [10(Base interest rate) +2(Loan product level) +1(Loan account level)]

Sep 2,2015 - 13% = [10(Base interest rate) +2(Loan product level) +1(Loan account level)]

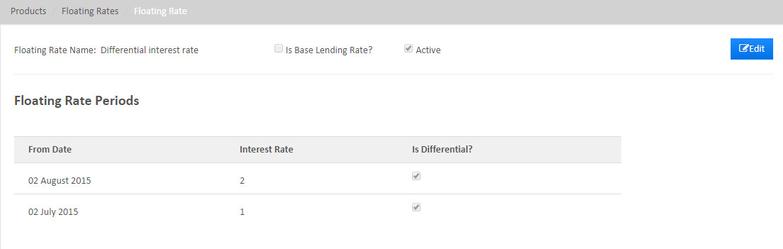

Scenario 3: With "Is differential enabled"

a) Floating Rate definition (Admin>>Product>>Floating Rate)

- Base Lending Rate (Must be Unchecked boxed),

- Is differential (Checked box) defined as shown in the image below

b) Loan Product definition (Admin>>Product>>Loan Product)

In the term section - Selected Floating rate is Differential rate

- Differential Rate is 2% (Product level)

c) Loan Account definition (Client>>New Loan application)

In term section - Interest Rate differential - 1%

- Is Floating Rate - Enabled (Checked box)

d) In the loan account page >> Floating interest rates

As you could see for the interest rate, i.e

July 2,2015 - 14% = [10(Base interest rate) +1(Differential rate chart) +2(Loan product level) +1(Loan account level)]

Aug 2,2015 - 15% = [10(Base interest rate) +2(Differential rate chart) +2(Loan product level) +1(Loan account level)]

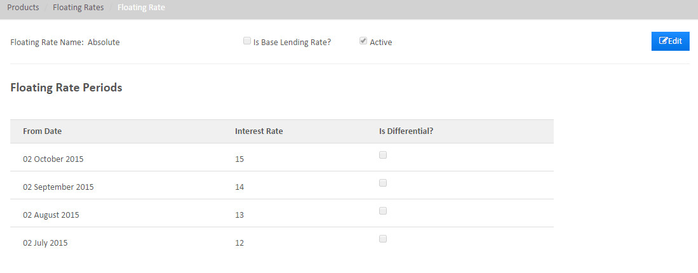

Scenario 4: Without - Base lending and Is differential

a) Floating Rate definition (Admin>>Product>>Floating Rate)

- Base Lending Rate (Unchecked boxed),

- Is differential (Unchecked box) defined as shown in the image below

b) Loan Product definition (Admin>>Product>>Loan Product)

In the term section - Selected Floating rate is Absolute

- Differential Rate is 2% (Product level)

c) Loan Account definition (Client>>New Loan application)

In term section - Interest Rate differential - 1%

- Is Floating Rate - Enabled (Checked box)

d) In the loan account page >> Floating interest rates

As you could see for the interest rate i.e

July 2,2015 - 13% = [10(Base interest rate) +2(Loan product level) +1(Loan account level)]

Aug 2,2015 - 14% = [10(Base interest rate) +2(Loan product level) +1(Loan account level)]

Related articles