Closing Entries

Create an accounting closure

To close journal entries for an office, do the following:

- On the Mifos toolbar, click Accounting to open the Accounting menu.

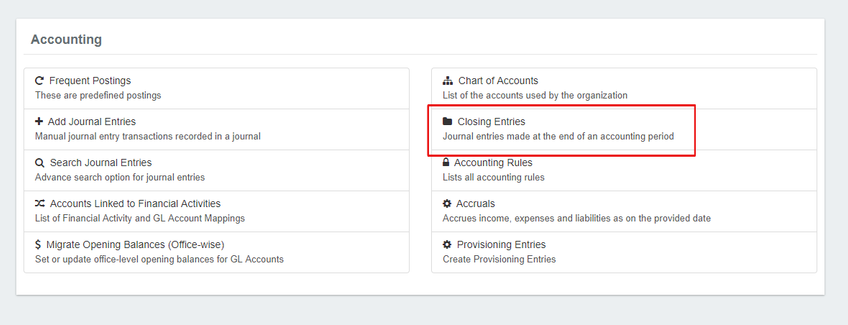

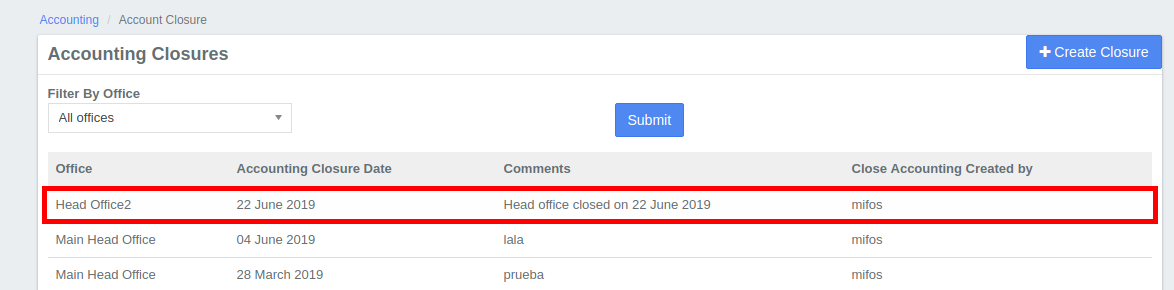

- On the Accounting menu, click Closing Entries to open the Closed Accounting Details dialog.

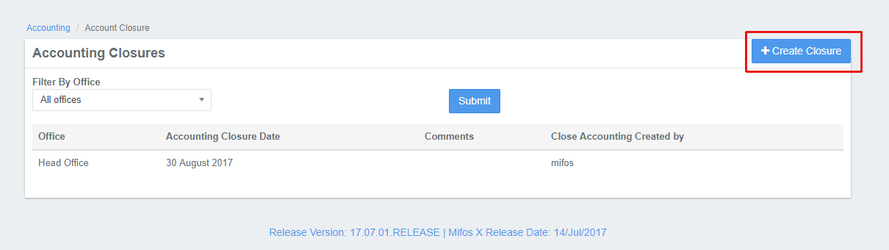

- In the Closed Accounting Details dialog, click Create Closure to open the Create Closure dialog.

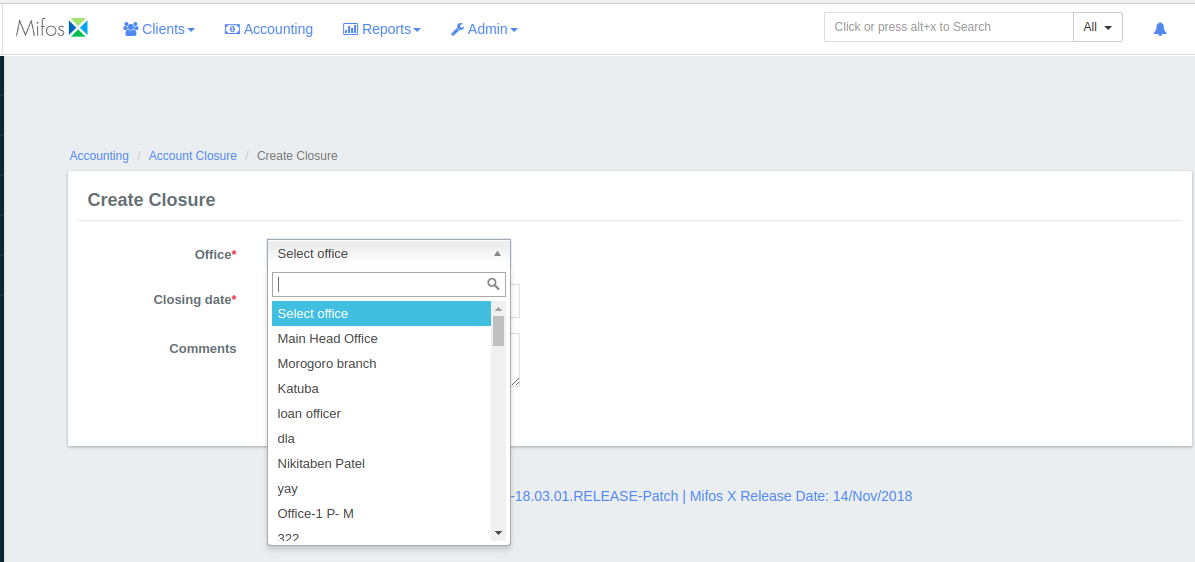

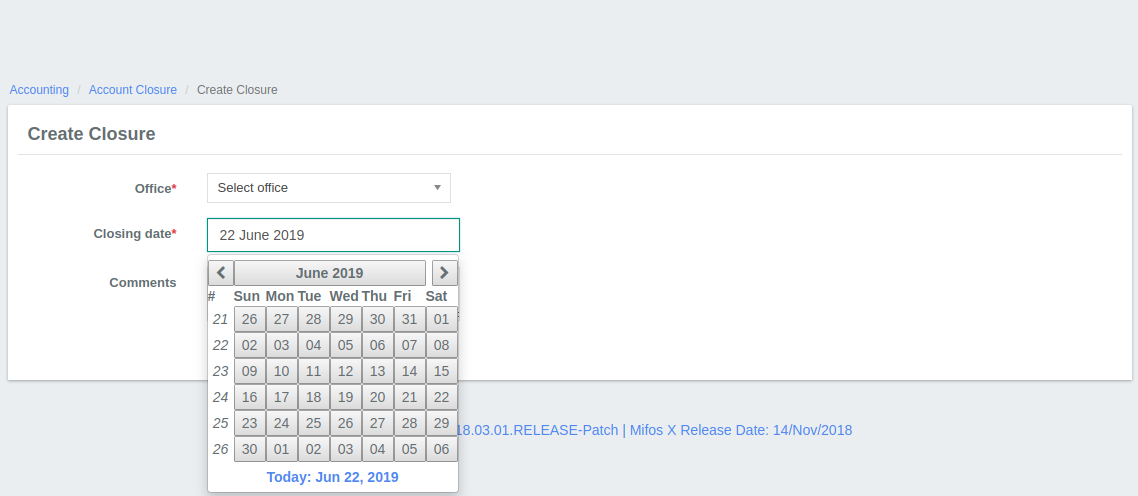

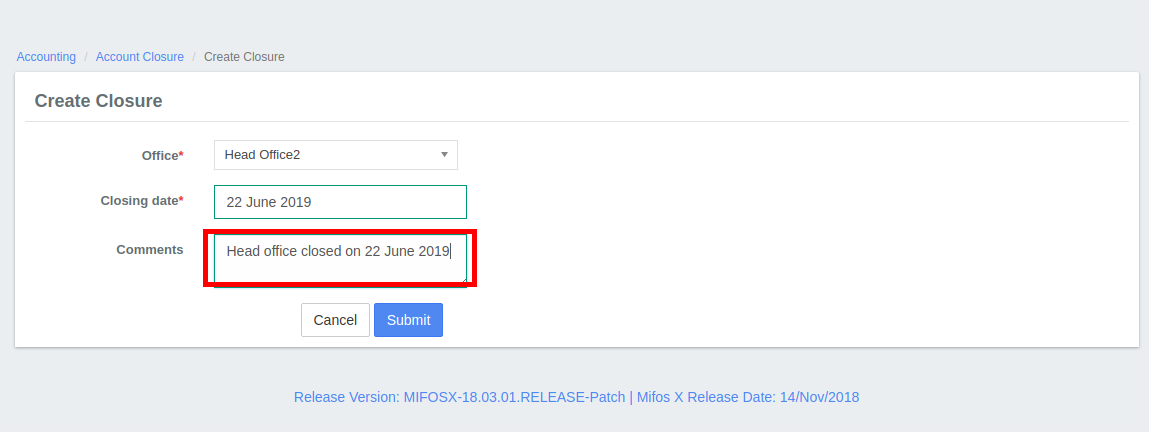

- In the Create Closure dialog, enter the closure details:

- In the Office list, select the office you want to close to accounting.

- In the Closing date box, click in the box and then choose the date from the pop-up calendar. Use the left and right arrow keys beside the month and year to change the month.

NOTE: The closing date defaults to the current date. - In the Comments box, enter an optional comment.

- In the Office list, select the office you want to close to accounting.

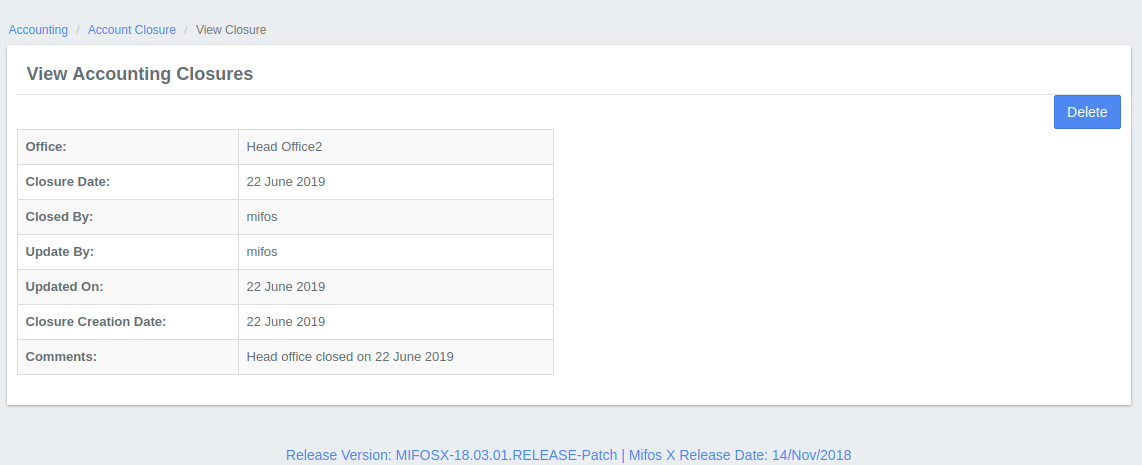

- Click the Submit button to complete the closure and view the closure details.

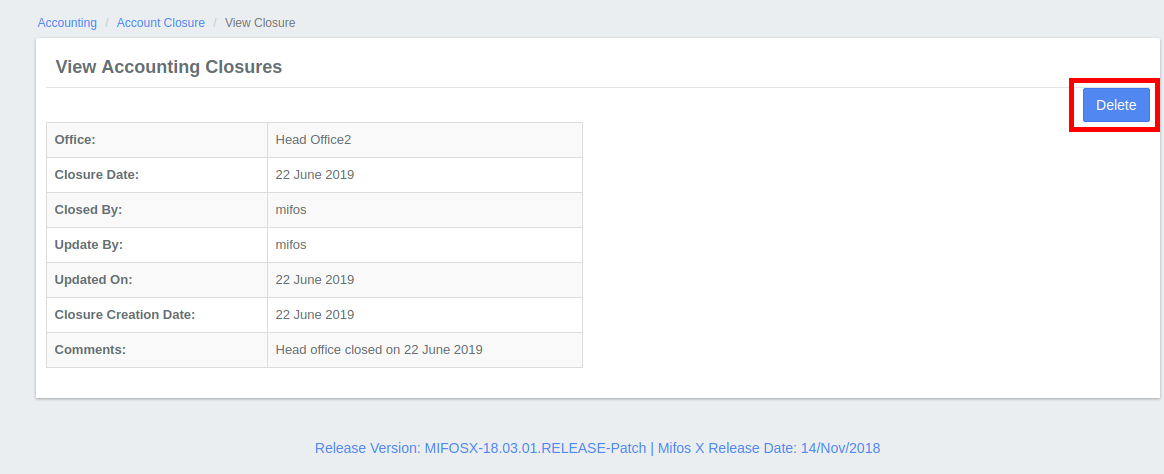

Delete an accounting closure

If you backdate a transaction to a date before the closure date, you will receive the following error:

Key Error Messages

You must first delete the closure before you can backdate the transaction.

To delete an accounting closure, do the following:

- On the Mifos toolbar, click Accounting to open the Accounting menu.

- On the Accounting menu, click Closing Entries to open the Closed Accounting Details dialog.

- In the Closed Accounting Details dialog, click the accounting closure you want to delete.

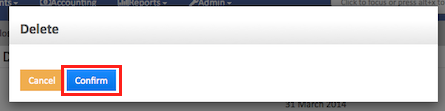

- Click Delete.

- In the popup dialog, click Confirm to delete the account closure.

You can now complete the postdated transaction.

Related articles

, multiple selections available, Use left or right arrow keys to navigate selected items