Charges

Beginning at the main screen, select Admin, Products from the drop-down menu. This will launch the Products menu.

Select Charges.

Creating a Charge

Click on +Create Charge.

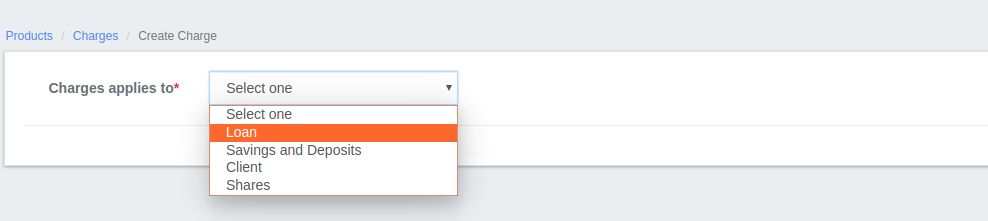

Loan charge

- Select Charges apply to as Loan.

- Fill in the charge fields described in the Charge Fields table below.

- Select Charge time type

Disbursement: Gets charged at the time of loan disbursement, provide amount gets collected separately (Not from the loan amount).

Specified due date: Gets charged on the provided date.

Installment Fee: Gets charged on every loan installment.

Overdue Fees: Gets charged if there is an overdue, this is a penalty charge.

Tranche Disbursement: Gets charged for Tranche loan disbursement.

Click Submit.

Savings & deposit charge

- Select Charges apply to as Savings & deposit.

- Fill in the charge fields described in the Charge Fields table below.

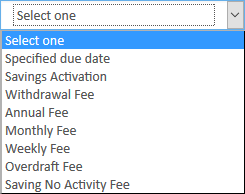

- Select Charge time type

Specified due date: Gets charged on the provided date.

Savings Activation: Gets charged at the time of Savings activation.

Withdrawal Fee: Gets charged at the withdrawal of savings amount.

Annual Fee: Gets charged every annually.

Monthly Fee: Gets charged every monthly.

Weekly Fee: Gets charged every weekly.

Overdraft Fee: Gets charged on Overdraft account.

Saving no activity fee: Get charged on no savings account activity. - Click Submit.

Client charge

- Select Charges apply to as Client charge.

- Fill in the charge fields described in the Charge Fields table below.

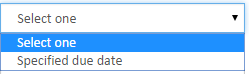

- Select Charge time type

Specified due date: Gets charged on the provided date.

- Click Submit.

Share charge

- Select Charges apply to as Share charge.

- Fill in the charge fields described in the Charge Fields table below.

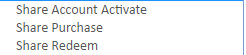

Select Charge time type

Share Account Activate: Gets charged at the time of Share activation, charge calculation can be only be flat not % of amount.

Share Purchase: Gets charged at the time of share purchase.

Share Redeem: Gets charged at the time of redeeming of shares.

3. Click Submit.

Editing charge

Select charge from the available charge list >> Click on Edit button

Then click on Submit button.

Viewing charges

Click on Admin>>Products>>Charges

Charge Fields

Field Name (attribute) | Description | Example | Validations (if applicable) |

|---|---|---|---|

| Name | A descriptive name for the charge. The name provided in this field will populate charge selection lists on applicable product and account forms. | Service Fee | Required field Alphanumeric |

| Currency | Select the currency to be used when the charge is applied. The product and charge currency must be the same to be valid. Set up multiple charges if the same charge is required for products set up in different currencies. (Note: If you don't find the currency type you need from drop-down menu, you need to define it. Click Here to see How to define the currency) | Indian Rupee | Required field Select from list |

| Charge time type | Select the desired charge time type from the list. There will be different charge time types in the list depending on the product type select in Charges applies to. | Specified due date | Required field Select from list |

| Charge calculation | Select the desired charge calculation from the list. There will be different charge calculation options in the list depending on the product type selected in Charges applies to. | Flat | Required field Select from list |

| Charge payment by | This field will display for loan product charges only. Select the desired charge payment method from the list. | Account Transfer | Required field for loan product charges Select from list |

Add Fee Frequency (loan charges only) Charge Frequency Frequency Interval | This option will display for loan product charges only. To add a fee frequency, check Add Fee Frequency. If Add Fee Frequency is checked the Charge Frequency and Frequency Interval fields will appear and must be filled in. | Checked monthly 1 | Check Add Fee Frequency to add a fee frequency; uncheck to remove a fee frequency Select Charge Frequency from list Numeric |

| Amount | The value in this field is used with Charge calculation to calculate the amount to be charged to the client. Example: Apply a service fee of 25 rupees (flat calculation) monthly by transferring the funds from another account. | 25 | Required Numeric |

| Active | If checked, this charge is available to associate with products and accounts. If unchecked, this charge is not available to associate with products and accounts. | Checked | Checked indicates an Active charge |

| Is penalty? | If checked, this charge is marked as a penalty, rather than a fee. | Unchecked | Checked indicates that the charge is a penalty. Unchecked indicates that the charge is a fee. |

If you select 'Charge Time Type' as Overdue Fees, then you have to check 'Is Penlty?' checker.

Related articles

Filter by label

There are no items with the selected labels at this time.