Mobile Money Integration

Goals

- Integrate Mifos with mobile money platforms so data can be synchronized with the disbursements, repayments, and deposits being initiated through the mobile money platform.

- It can enable financial institutions to go completely paperless once mobile money is rolled out and integrated with the core banking system.

Background and strategic fit

Mobile Money is in high demand across Mifos users worldwide yet it still has not been as widely adopted by our customer base because of the need for access to Open APIs from the mobile money providers and hence our ability to integrate with their mobile money systems.

Integration from a technical standpoint once the API is made available from the mobile money provider isn't a large amount of work but getting the specific use cases and requirements needed for mobile money integration is critical and we can only move forward if users and partners in the community express the specific requirements they have. Musoni Services has integrated with various mobile money providers throughout Sub-Saharan Africa via Musoni System which is built on top of the Mifos X platform

The following provides good background on mobile money integration:

- CGAP on Open APIs - http://www.cgap.org/blog/can-open-apis-accelerate-digital-finance-ecosystem

- Safaricom M-Pesa API Guide & Documentation: https://www.safaricom.co.ke/business/corporate/m-pesa-payment-services/m-pesa-api

- Specs for Mifos 2 Mobile Money Integration (File-Level API integration for M-Pesa)

- Mobile Money Providers by Region (spreadsheet research led by GCI students)

- Notes from on M-Pesa Requirements

Assumptions

- Requirements must be driven by implementation by a specific customer or partner

- Preference is to do API-level integration if available, will only do file-level integration if that is the option.

Customers

| Customer | Location | Description | Status | Mobile Money Provider | API or File-Level | USSD Gateway | Digital Currency | |

|---|---|---|---|---|---|---|---|---|

| Financial Institution Name | Country | Overview of Requirements | ||||||

| Intrasoft Technologies | Kenya | M-Pesa (Safaricom) | File-Level but access to APIs is now available | |||||

| Digamber Finance | ||||||||

| Nuru International | ||||||||

| Esperanza | Required | Required | ||||||

| Valee SACCO | Uganda | In Development by Omexit | Airtel Money MTN Money | API but only through integrators - working with Beyonic. Alternatives are Yo Pay. | ||||

| Cameroon - Emmanuel Nganyu | Cameroon | In Discussion | API but access is slowly opening up. | |||||

| World Relief | Rwanda | TigoCash | ||||||

| Tanzania |

Requirements

| # | Title | User Story | Importance | Notes |

|---|---|---|---|---|

| 1 | Deposit into Savings Account | As a client I should be able to deposit money into my savings account from my mobile money account | Must Have | |

| 2 | Withdraw from Savings Account | As a client I should be able to withdraw money from my savings account into my mobile money account | Must Have | |

| 3 | Loan Disbursement | As a client I should be able to receive disbursed loan with my mobile money aacount | Must Have | |

| 4 | Loan Repayment | As a client I should be able to repay my loan balance using my mobile money account. | Must Have |

User interaction and design

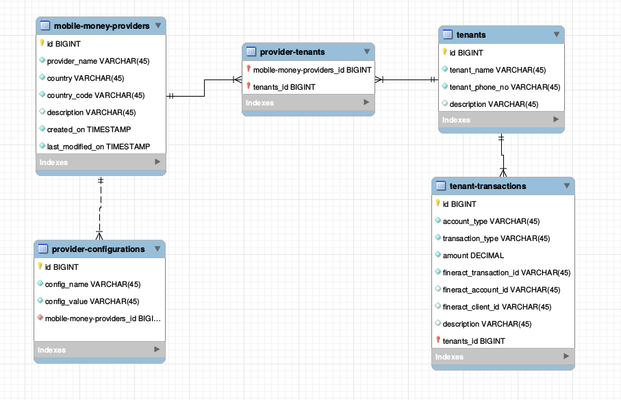

Database Design

Questions

Below is a list of questions to be addressed as a result of this requirements document:

| Question | Outcome |

|---|---|