Sliding Interest Rates for Savings Deposits

Sliding Interest Rates for Savings Deposits in Mifos X

This document describes the enhancement to the Savings product to support a “Sliding Interest Rate” feature.

Contents:

Overview of Sliding Interest Rates for Savings Deposits

Interest Rate Charts

Interest Incentives

Savings Deposits Product Definition

Interest Rate Chart Definition for Savings Deposit

Interest Incentives for a specific band in the Interest Rate Chart for a Savings Deposit

1. Overview of Sliding Interest Rates for Savings Deposits

In the Savings Deposits product definition screen, current functionality allows user to specify a “Nominal Annual Interest” rate. This is a mandatory field.

In this enhancement, an option will be given to the user to either specify a “Nominal Annual Interest” or an “Interest Rate Chart”.

Typically, the Interest Rate Chart will be based on different ranges of amounts. Additionally, incentives may be specified based on client parameters like gender, age etc

2. Interest Rate Charts for Savings Products

The “Interest Rate Chart” for a savings product defines an interest rate scheme that will have a band (or range) of deposit amounts and the associated interest rates applicable along with incentives for each band.

The interest rate chart will be maintained along with the creation of the savings deposit product and is associated to the savings product. For now, it will not be maintained independent of the deposit product. Logically, interest rate charts can be “attached” to different types of products like, Savings accounts, Term deposits, Recurring deposits etc.

Example:

S.No. | From | To | Interest Rate | Ladies Incentive | Senior Citizen Incentive | Description |

1 | 0 | 10,000 | 4% | +0.5% | +0.5% | 12 Months |

2 | 10,001 | 15,000 | 4.50% | +0.5% | +0.5% | 18 Months |

3 | 15,001 | 20,000 | 5% | +0.5% | +0.5% | 24 Months |

4 | 20,001 | 40,000 | 6% | +0.5% | +0.5% | 2-3 years |

5 | 40,001 | - | 6.50% | +0.75% | +0.75% | 3-5 years |

The interest rates and the associated incentives need to be versioned with each change (or if maker-checker is enabled, then with each approval).

When a savings deposit account is created, and an interest rate chart is associated to it, then internally, the current version of the interest rate chart is associated to the savings deposit.

Open question: If interest rates are changed, then will existing Savings Accounts for this product also be impacted as these new interest rates will be applicable to them too?

3. Interest Incentives

This feature in Mifos X will allow the operations manager to create interest incentive schemes applicable for a specific band in interest rate. For example, ladies get an additional 0.5% interest for deposits and senior citizens get an additional 0.5% interest for savings deposits

4. Savings Deposits Enhancements

4.1 Savings Deposit Product Definition

Additional data to be captured during Savings production definition:

Field Name | Type | Priority Must – 1 Should – 2 Could – 3 | Description | Validations / Notes |

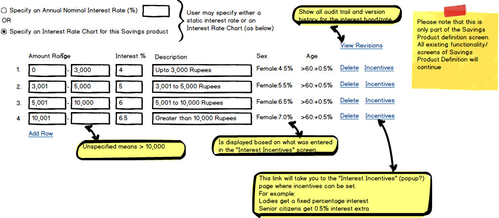

Specify an Annual Nominal Interest Rate (%) OR Specify an Interest Rate Chart for this Savings product | Radio Button | Must Have | Allows user to specify either a static interest rate or an Interest Rate Chart |

|

View Revisions | Link | Should Have | Clicking on this link will show the list of previous revisions made to this Interest Rate Chart. | The screen displayed on clicking this link will be the same as the Interest Rate Chart screen, except that in the “List of Interest Rate Charts” it will show the same Interest Rate Chart, with the available versions of it and the date of revision. The list will be displayed in descending order of date of revision. All other fields/functionality will be the same, except that the View Revisions Link will not be displayed and all fields will be in the read only mode. |

S.No. | Static Text | Must Have | Running sequence number |

|

Amount Range | 2 text boxes - Numeric without decimals | Must Have | User can select applicable amount range, for example: user enters 0 and 10,000,000, for “0 to 10 million (rupees)” – which is the standard limit defined by central bank norms | Upto 12 digits allowed Either, Period Range or Amount Range or Both can be specified. Both Period Range and Amount Range cannot be blank. |

Interest % | Numeric with decimals | Must Have | Interest rate applicable for this “band” (“band” is a period and the associated amount range) | 4 digits before and 5 digits after decimal point allowed. Cannot be blank, but can be zero. |

Description | Textbox | Must Have | Description for this “band” | Upto 50 chars. Cannot be blank. |

Incentive field(s) | Multiple columns | Should Have | The customer or account attributes that were selected in the “Interest Incentive” screen is displayed as header. The value displayed under this column will be | To edit the values for this field, click on “Incentives” link (or icon). |

Delete | Link or Icon | Must Have | Will remove this band. | User is asked for confirmation (popup with yes or now) before this band is removed from screen. |

Incentives | Link or Icon | Must Have | Takes user to the “Interest Incentive” screen where user can specify the incentives that are applicable for this band. |

|

Add Row | Link or Icon | Must Have | Adds a new “band” row |

|

Save Button for the screen | Button | Must Have | If new product, Interest Rate Chart, will save this internally as “Version 1”. If an existing product is being modified and there is a change to the Interest Rate Chart, then the existing version will not be modified internally, but a new “Version Number” is generated and the interest rate chart is stored against this. |

|

Sample Screen:

4.2 Interest Incentives for a specific band in the Interest Rate Chart for a Savings Deposit

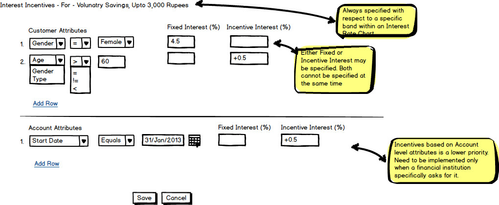

This screen will only be invoked from the Interest Rate Chart screen. It will be invoked for a specific band within a validity period in the Interest Rate Chart.

This screen will have 2 sections:

a) Customer Attributes – to specify the interest incentives based on Customer Attributes (like gender / age)

b) Account Attributes – to specify the interest incentives based on Account Attributes (like an additional 0.5 interest for loans approved in the month of Jan)

Data to be captured:

Field Name | Type | Priority Must – 1 Should – 2 Could – 3 | Description | Validations / Notes |

Title line | Static Text | Must Have | Displayed based on the Interest Rate Chart product name/validity period and the “band” description. Concatenation of the following fields: Savings Deposit Product àName Interest Rate Chart à A specific Validity Period A specific Band à Description |

|

Customer Attributes |

| Must Have |

|

|

Drop down of customer attributes | Dropdown | Must Have | For now, have Gender and Age. Later it should be possible to add other attributes too | Has to be selected.

Note: Gender needs to be added as a standard attribute for Personal Customers in the Client screens |

Drop down of condition | Dropdown | Must Have | Will have the following values = - Equals != - Not Equals < - Is Less Than > - Is Greater Tha | Has to be selected. |

Comparison Value | Dropdown or Text box (depending on the type of the Customer Attribute) | Must Have | If dropdown, then same as the values for Customer Attribute selected.

Else, user enters value | If text box, max length 150. |

Fixed Interest (%) | Textbox - Numeric with decimals | Must Have | Interest rate applicable for customer with this attribute having this comparison value. | 4 digits before and 5 digits after decimal point allowed. Cannot be blank, but can be zero.

Either “Fixed Interest (%)” or “Incentive Interest (%)” can be specified. Both cannot be specified at the same time and both cannot be blank. |

Incentive Interest (%) | Textbox - Numeric with decimals | Must Have | Additional Interest rate applicable for customer with this attribute having this comparison value. | Plus symbol (+) following by 4 digits before and 5 digits after decimal point allowed. Cannot be blank, but can be zero.

Either “Fixed Interest (%)” or “Incentive Interest (%)” can be specified. Both cannot be specified at the same time and both cannot be blank. |

Add Row | Link or Icon | Must Have | Adds a row for additional Customer attributes for specifying interest incentives |

|

Account Attributes |

| Could Have | Similar functionality as customer attributes, except that drop down will have account specific attributes (like open date, approved date etc.) |

|

Save button | Button | Must Have |

| One possible implementation: Save does not save to database, but is temporarily saved to the Interest Rate Chart screen. This data is saved only when Interest Rate Chart is saved. |

Sample Screen:

5. Interest Calculation changes for Savings Deposits

If interest is specified as “Nominal Annual Interest” rate then, no changes.

If an interest rate chart is used then, “Interest Compounding Period” and “Interest Posting Period” will continue to be used as is. “Interest Calculated Using” field will also continue to be used as is.

However, the amount applicable for “Interest Calculated Using” will be “bucketed” into one of the bands and the interest rate applicable for the band will be used.

For example, if “Interest Calculated Using” is specified as “Average Balance” and “Interest Compounding Period” is monthly, (assuming the above sample interest rate table from section 2 is used):

1st month: monthly average balance = 8,000 and

2nd month: monthly average balance = 13,000

Then for 1st month, interest rate would be 4%

And for 2nd month, interest rate would be 4.5%

If the customer was a lady who is above 60 year of age:

Then for 1st month, interest rate would be 5%

And for 2nd month, interest rate would be 5.5%

(i.e. 0.5% incentive interest for a lady client and an additional 0.5% incentive interest for senior citizens)