About Term Deposit Accounts

A term deposit account is an instance of a term deposit product. Depending on your financial institution and the term deposit product definition a term deposit account is based upon, the term deposit account may be a fixed deposit account or a recurring deposit account. In all cases, a term deposit account has a unique account number, a specified interest rate, and it is owned by one and only one client, group or center.

A term deposit account can be created for an active client, group or center based on a term deposit product that is active on the submitted date. When a term deposit account is created, it inherits the rules and defaults from the term deposit product. Your financial institution may allow some of the inherited information to be modified for a term deposit account, depending on how the term deposit product is defined.

Group/center term deposit accounts. By default, all members of a group/center are part of all the term deposit accounts of the group. Members are allowed to deposit and withdraw from the group/center term deposit account.

A center, group or client can have multiple term deposit accounts of the same or different term deposit product but a single term deposit account cannot be held by multiple centers, groups or clients. Term deposit accounts cannot be transferred from one client, group or center to another.

Once approved, term deposit accounts cannot be deleted.

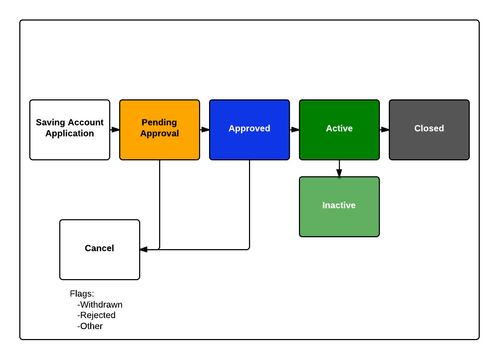

The term deposit account life cycle is illustrated in the Mifos X Term Deposit Account Life cycle diagram. Term deposit account statuses are visually indicated in Mifos X using the color scheme illustrated in the Mifos X Term Deposit Account Life cycle diagram.

Figure Mifos X Term Deposit Account Life cycle

Figure Mifos X Term Deposit Account Life cycle

The term deposit account actions/transactions availability and affect on the saving account life cycle status are:

Term Deposit Account View/Navigation

(**under construction**)