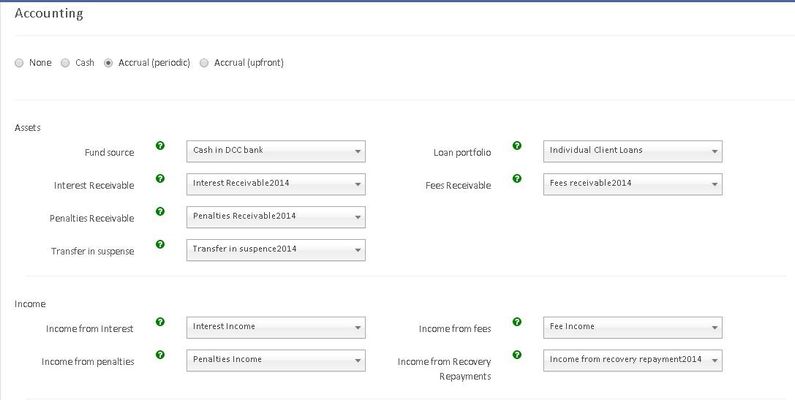

Accounting Loan Product Fields

Loan Product Fields—Additional Fields for Cash and Accrual Accounting

| Field Name (attribute) | Description |

|---|---|

| Assets | |

| Fund source | An Asset account (typically Bank or Cash) that is debited during repayments/payments and credited using disbursal. Applicable to Cash, Accrual (periodic), Accrual (upfront) |

Loan portfolio | An Asset account that is debited during disbursement and credited during principal repayment/write-off. Applicable to Cash, Accrual (periodic), Accrual (upfront) |

| Interest Receivable | An Asset account that is used to accrue interest. Applicable to Accrual (periodic), Accrual (upfront) |

| Fees Receivable | An Asset account that is used to accrue fees. Applicable to Accrual (periodic), Accrual (upfront) |

| Penalties Receivable | An Asset account that is used to accrue penalties. Applicable to Accrual (periodic), Accrual (upfront) |

| Transfer in suspense | An Asset account that is used as a suspense account for tracking portfolios of loans under transfer. |

| Income | |

| Income from interest | An Income account that is credited during repayment. Applicable to Cash, Accrual (periodic), Accrual (upfront) |

| Income from fees | An Income account that is credited when a fee is paid by account holder on this account. Applicable to Cash, Accrual (periodic), Accrual (upfront) |

| Income from penalties | An Income account which is credited when a penalty is paid by account holder on this account. Applicable to Cash, Accrual (periodic), Accrual (upfront) |

| Income from Recovery Repayments | An Income Account that is credited during recovery repayments Applicable to Cash, Accrual (periodic), Accrual (upfront) |

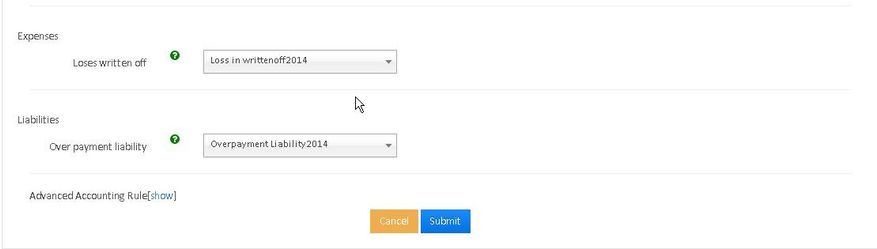

| Expenses | |

| Loses written off | An Expense account that is debited on principal write-off (also debited in the events of interest, fee and penalty written-off in case of accrual based accounting). Applicable to Cash, Accrual (periodic), Accrual (upfront) |

| Liabilities | |

| Overpayment liability | A Liability account that is credited on overpayments and credited when refunds are made to client. Applicable to Cash, Accrual (periodic), Accrual (upfront) |

Advanced accounting rules (optional) The advanced accounting rules allow for finer detail in mapping payment types to fund sources, fees to income accounts and penalties to income accounts. Applicable to Cash, Accrual (periodic), Accrual (upfront) | |

Configure Fund Sources for Payment Channels Payment Type Fund Source | A different Fund Source for each Payment Channel may be specified. Select a Payment Type from the Payment Type list (e.g.,Cash, check, m-pesa, etc). Select a Fund Source from the Fund Source list. |

Map Fees to Income Accounts Fees Income Account | A different Income Account for each Fee type may be specified. Select a Fee from the Fee list. Select an Income Account from the Income Account list. |

Map Penalties to Specific Income Accounts Penalty Income Account | A different Income Account for each Penalty type may be specified. Select a Penalty from the Penalty list. Select an Income Account from the Income Account list. |

- The following screenshots show an example of how to define Accrual (periodic) while defining the loan products:

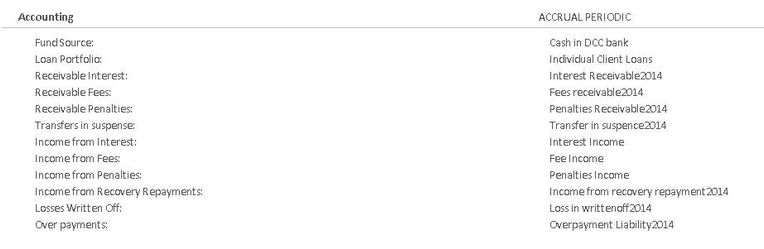

- After this, Click on the 'Submit' button to create the loan product with Accrual (periodic) Accounting. The summary of the Accrual Accounting (periodic) done for the loan product can be seen in the following screenshot.